Question: show excel formulas in calculations and =formulatext or explain (a) The Belle Beauty Compary (BBC) eamed 10 a share last year and paid a dividend

show excel formulas in calculations and =formulatext or explain

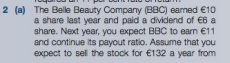

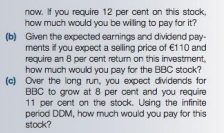

(a) The Belle Beauty Compary (BBC) eamed 10 a share last year and paid a dividend of 6 a share. Next year, you expect BBC to earn E11 and continue its payout ratio. Assume that you expect to sel the stock for 132 a year from now. If you require 12 per cent on this stock, how much would you be wiling to pay for it? (b) Given the expected earnings and dividend payments it you expect a seling price of 110 and require an 8 per cent return on this investment, how much would you pay for the BBC stock? (c) Over the long run, you expect dividends for BBC to grow at 8 per cent and you require 11 per cent on the stock. Using the infinite period DCM, how much would you pay for this stock? (d) Based on new intomation regarding the popularity of beauty products, you revise your growth estimate for BBC to 9 per cent. What is the maximum P:E ratio you will apply to BBC, and what is the maximum price you will pay for the stock? (a) The Belle Beauty Compary (BBC) eamed 10 a share last year and paid a dividend of 6 a share. Next year, you expect BBC to earn E11 and continue its payout ratio. Assume that you expect to sel the stock for 132 a year from now. If you require 12 per cent on this stock, how much would you be wiling to pay for it? (b) Given the expected earnings and dividend payments it you expect a seling price of 110 and require an 8 per cent return on this investment, how much would you pay for the BBC stock? (c) Over the long run, you expect dividends for BBC to grow at 8 per cent and you require 11 per cent on the stock. Using the infinite period DCM, how much would you pay for this stock? (d) Based on new intomation regarding the popularity of beauty products, you revise your growth estimate for BBC to 9 per cent. What is the maximum P:E ratio you will apply to BBC, and what is the maximum price you will pay for the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts