Question: show excel work please the last number on the bottom is 7.5%. that part is hard to read The President of Falcon Plastics is upbeat

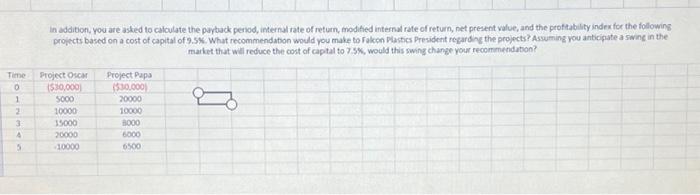

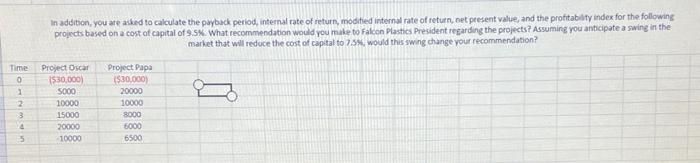

The President of Falcon Plastics is upbeat about their economic outlook. However, she knows there is a need to define and outline avenues by which projects are evaluated As such, you have been recrulted to examine, make recommendations, and educate them on capital budgeting tools. The leadership has asked you to explain the following: A) Why does the net present value matter? B) Why might a project be plagued with multiple internal rates of returns concerns? C) Now might you explaipthe relationship between WACC, IRA, NP, and the protitability index? in addition, you are asked to calculate the paytack perkod, internal rate of retum, modified internal rate of return, net present value, and the proftability index for the following proikcts based on a cost of capital of 9.5\%. What recommendabon would you make to rakcen Dastics President regarding the projects? Assuming you anticipate a swine in the market that will reduce the cost of captal to 7.5\%, would this swing change your recommendabon? The President of Fakcon Plastics is upbeat about their economic outlook. However, she knows there is a need to define and outline avenues by which projects are evaluated. As such, you have been recruited to examine, make recommendations, and educate them on capital budgeting tools. The leadership has asked you to explain the following: A) Why does the net present value matter? 8) Why might a project be plagued with multiple internal rates of returns concerns? C) How might you explain the relationship between WACC, IRR, NPV, and the grofitability index? Inadditon, you ate akked to calculate the paybuck period, internal rate of return, modited internol nate of return, net peesent value, and the profitabllty index for the following. projects based on a cost ot capital of 9.5W. What recommendation would you male to falcon Plastics President regarding the projects? Assuming you anbicipate a swine in the market that will reduce the cont of captal to 7.5%, would this swing change your recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts