Question: Show formulas and explain steps and paste into answer box excel works and use formula text and screenshot entire page etc. show formulas and explain

Show formulas and explain steps and paste into answer box excel works and use formula text and screenshot entire page etc.

show formulas and explain steps. paste in answers in screenshot

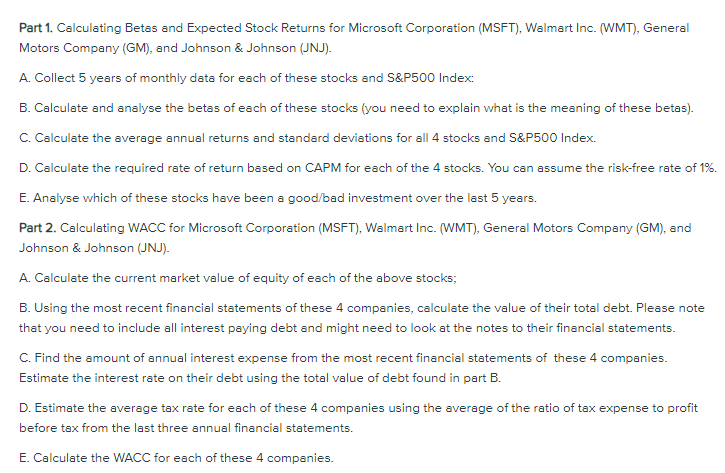

Part 1. Calculating Betas and Expected Stock Returns for Microsoft Corporation (MSFT), Walmart Inc. (WMT), General Motors Company (GM), and Johnson & Johnson (JNJ). A. Collect 5 years of monthly data for each of these stocks and S&P500 Index: B. Calculate and analyse the betas of each of these stocks (you need to explain what is the meaning of these betas). C. Calculate the average annual returns and standard deviations for all 4 stocks and S&P500 Index. D. Calculate the required rate of return based on CAPM for each of the 4 stocks. You can assume the risk-free rate of 1%. E. Analyse which of these stocks have been a good/bad investment over the last 5 years. Part 2. Calculating WACC for Microsoft Corporation (MSFT), Walmart Inc. (WMT), General Motors Company (GM), and Johnson & Johnson (JNJ). A. Calculate the current market value of equity of each of the above stocks; B. Using the most recent financial statements of these 4 companies, calculate the value of their total debt. Please note that you need to include all interest paying debt and might need to look at the notes to their financial statements. C. Find the amount of annual interest expense from the most recent financial statements of these 4 companies. Estimate the interest rate on their debt using the total value of debt found in part B. D. Estimate the average tax rate for each of these 4 companies using the average of the ratio of tax expense to profit before tax from the last three annual financial statements. E. Calculate the WACC for each of these 4 companies. Part 1. Calculating Betas and Expected Stock Returns for Microsoft Corporation (MSFT), Walmart Inc. (WMT), General Motors Company (GM), and Johnson & Johnson (JNJ). A. Collect 5 years of monthly data for each of these stocks and S&P500 Index: B. Calculate and analyse the betas of each of these stocks (you need to explain what is the meaning of these betas). C. Calculate the average annual returns and standard deviations for all 4 stocks and S&P500 Index. D. Calculate the required rate of return based on CAPM for each of the 4 stocks. You can assume the risk-free rate of 1%. E. Analyse which of these stocks have been a good/bad investment over the last 5 years. Part 2. Calculating WACC for Microsoft Corporation (MSFT), Walmart Inc. (WMT), General Motors Company (GM), and Johnson & Johnson (JNJ). A. Calculate the current market value of equity of each of the above stocks; B. Using the most recent financial statements of these 4 companies, calculate the value of their total debt. Please note that you need to include all interest paying debt and might need to look at the notes to their financial statements. C. Find the amount of annual interest expense from the most recent financial statements of these 4 companies. Estimate the interest rate on their debt using the total value of debt found in part B. D. Estimate the average tax rate for each of these 4 companies using the average of the ratio of tax expense to profit before tax from the last three annual financial statements. E. Calculate the WACC for each of these 4 companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts