Question: Show formulas used in excel to solve this question The 2018 income statement and comparative balance sheet of Sweet Valley, Inc. follow: SWEET VALLEY, INC.

Show formulas used in excel to solve this question

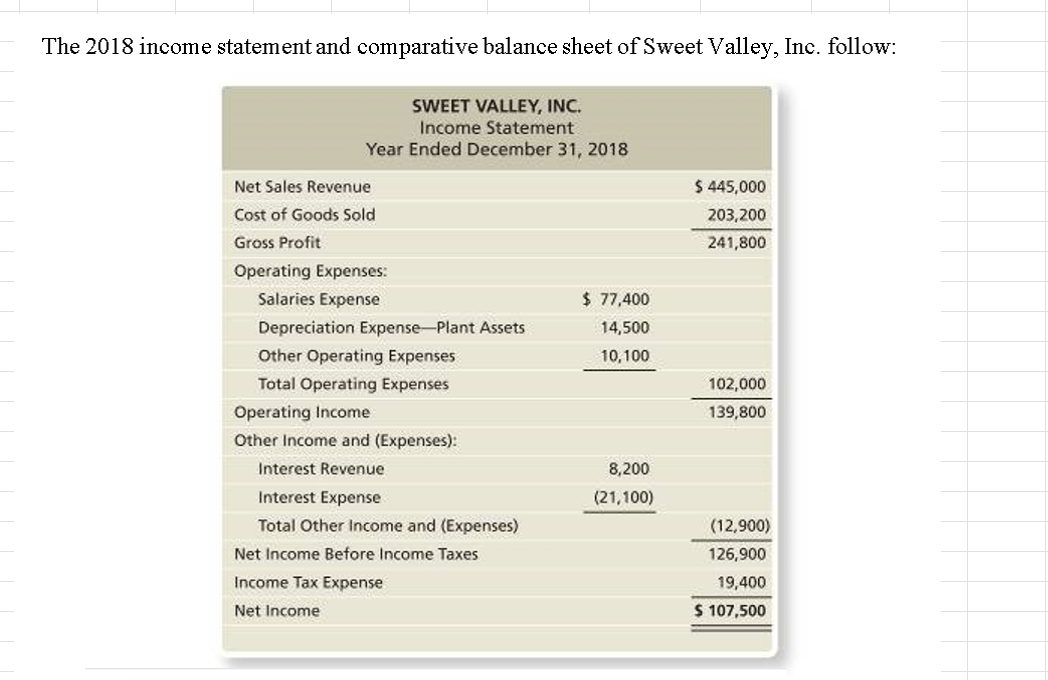

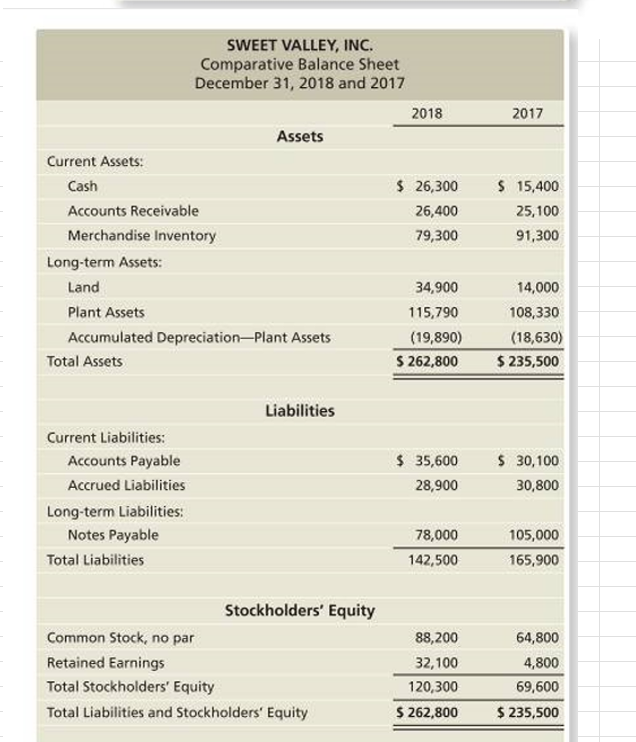

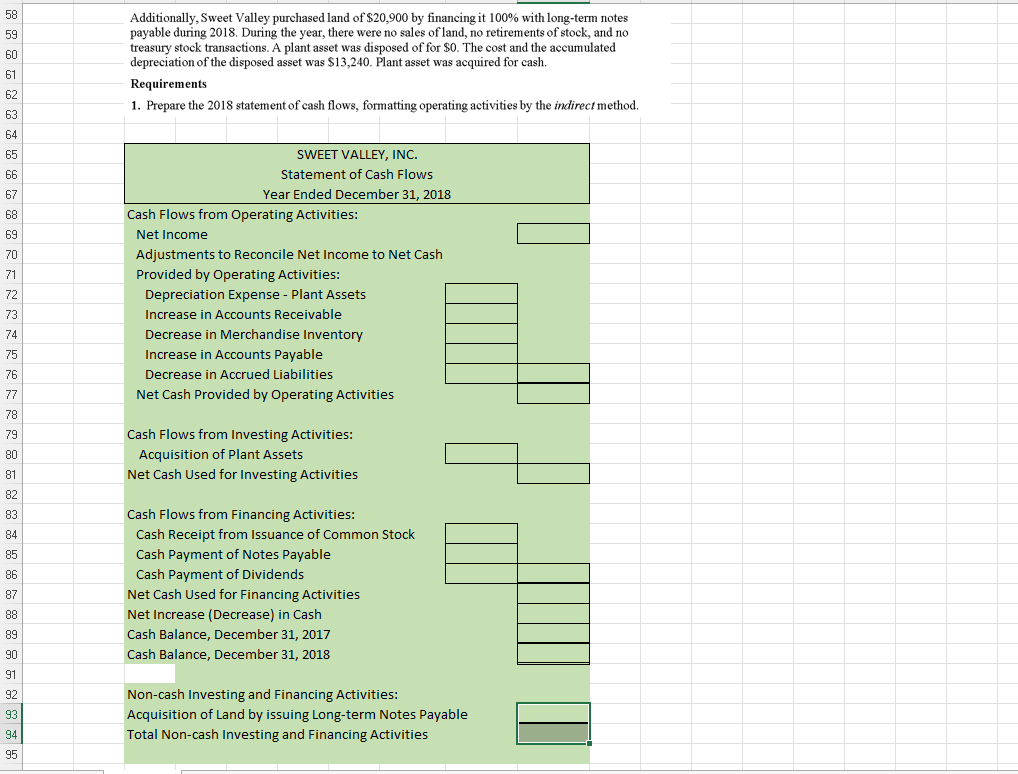

The 2018 income statement and comparative balance sheet of Sweet Valley, Inc. follow: SWEET VALLEY, INC. Income Statement Year Ended December 31, 2018 $ 445,000 203,200 241,800 $ 77,400 14,500 10,100 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense Depreciation Expense-Plant Assets Other Operating Expenses Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue Interest Expense Total Other Income and (Expenses) Net Income Before Income Taxes Income Tax Expense 102,000 139,800 8,200 (21,100) (12,900) 126,900 19,400 $ 107,500 Net Income SWEET VALLEY, INC. Comparative Balance Sheet December 31, 2018 and 2017 2018 2017 $ 26,300 26,400 79,300 $ 15,400 25,100 91,300 Assets Current Assets: Cash Accounts Receivable Merchandise Inventory Long-term Assets: Land Plant Assets Accumulated Depreciation-Plant Assets Total Assets 34,900 115,790 (19,890) $ 262,800 14,000 108,330 (18,630) $ 235,500 Liabilities $ 35,600 28,900 $ 30,100 30,800 Current Liabilities: Accounts Payable Accrued Liabilities Long-term Liabilities: Notes Payable Total Liabilities 78,000 142,500 105,000 165,900 Stockholders' Equity Common Stock, no par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 88,200 32,100 120,300 $ 262,800 64,800 4,800 69,600 $ 235,500 58 59 60 Additionally, Sweet Valley purchased land of $20,900 by financing it 100% with long-term notes payable during 2018. During the year, there were no sales of land, no retirements of stock, and no treasury stock transactions. A plant asset was disposed of for $0. The cost and the accumulated depreciation of the disposed asset was $13,240. Plant asset was acquired for cash. Requirements 1. Prepare the 2018 statement of cash flows, formatting operating activities by the indirect method. 61 62 63 64 65 66 67 68 69 70 71 72 SWEET VALLEY, INC. Statement of Cash Flows Year Ended December 31, 2018 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Depreciation Expense - Plant Assets Increase in Accounts Receivable Decrease in Merchandise Inventory Increase in Accounts Payable Decrease in Accrued Liabilities Net Cash Provided by Operating Activities 73 74 75 76 77 78 79 80 Cash Flows from Investing Activities: Acquisition of Plant Assets Net Cash Used for Investing Activities 81 82 83 84 85 86 87 Cash Flows from Financing Activities: Cash Receipt from Issuance of Common Stock Cash Payment of Notes Payable Cash Payment of Dividends Net Cash Used for Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2017 Cash Balance, December 31, 2018 88 89 90 91 92 93 94 Non-cash Investing and Financing Activities: Acquisition of Land by issuing Long-term Notes Payable Total Non-cash Investing and Financing Activities 95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts