Question: show full working out and solutions Question 3 Use the personal income tax rates in this unit to calculate (a) dependant rebates and (b) net

show full working out and solutions

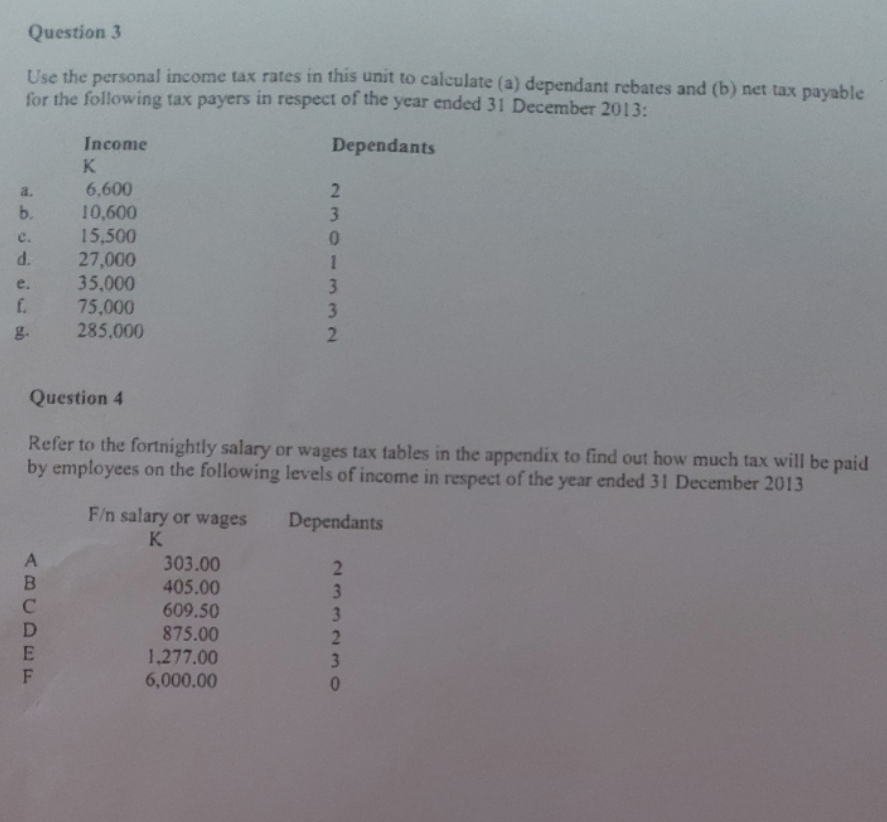

Question 3 Use the personal income tax rates in this unit to calculate (a) dependant rebates and (b) net tax payable for the following tax payers in respect of the year ended 31 December 2013: Dependants a. b. c. d. e. f. g. Income K 6,600 10,600 A B D E F 15,500 27,000 35,000 75,000 285,000 Question 4 Refer to the fortnightly salary or wages tax tables in the appendix to find out how much tax will be paid by employees on the following levels of income in respect of the year ended 31 December 2013 Dependants F/n salary or wages K 2 3 0 303.00 405.00 609.50 875.00 1,277.00 6,000.00 3 3 2 233230

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Answer Question 3 a Dependant rebates Income Dependants Dependant Rebate 6600 2 2 x 1500 3000 10600 ... View full answer

Get step-by-step solutions from verified subject matter experts