Question: show how it got the right answer please Question 14 Not answered You invest 45% of your money in Stock Y and the rest in

show how it got the right answer please

show how it got the right answer please

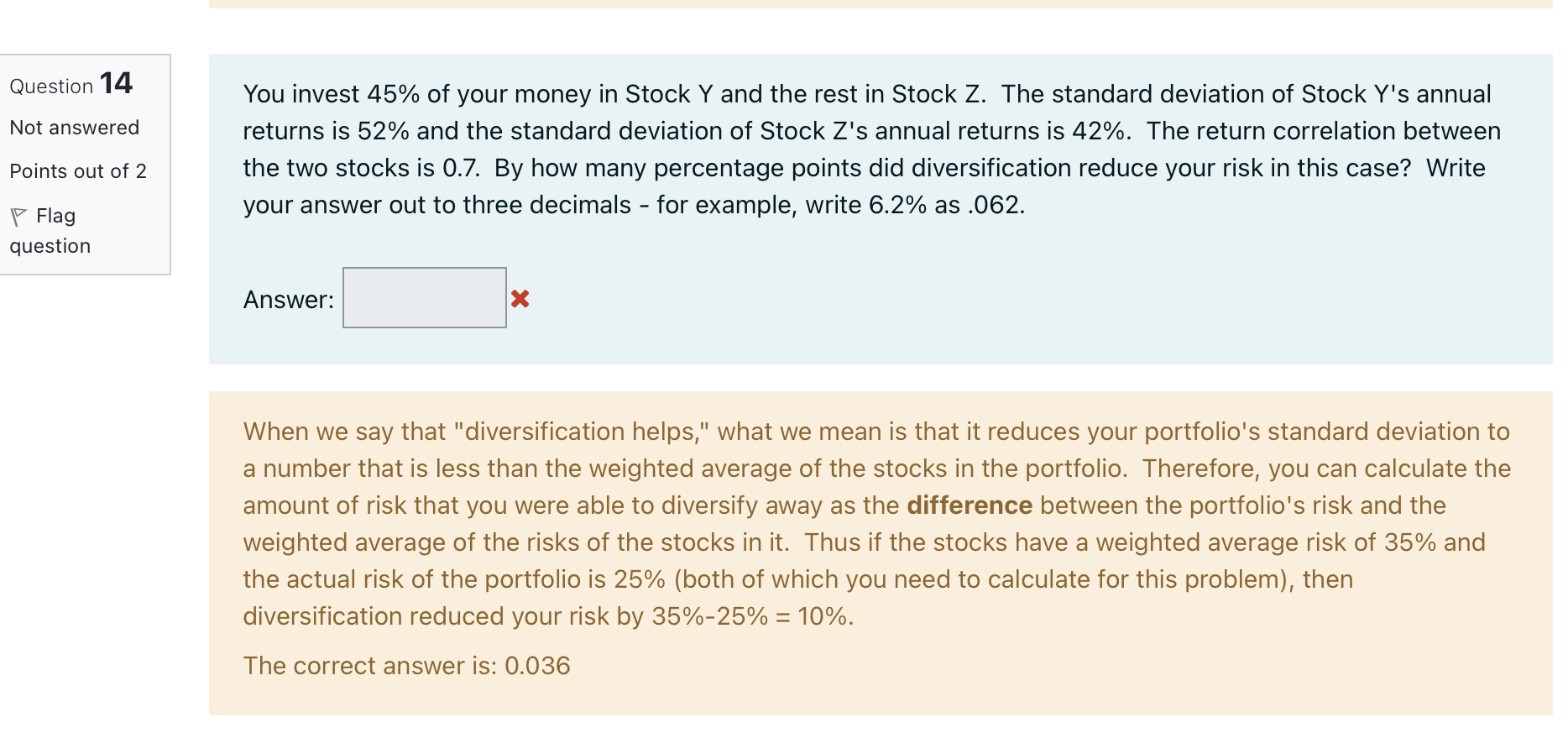

Question 14 Not answered You invest 45% of your money in Stock Y and the rest in Stock Z. The standard deviation of Stock Y's annual returns is 52% and the standard deviation of Stock Z's annual returns is 42%. The return correlation between the two stocks is 0.7. By how many percentage points did diversification reduce your risk in this case? Write your answer out to three decimals - for example, write 6.2% as .062. Points out of 2 P Flag question Answer: When we say that "diversification helps," what we mean is that it reduces your portfolio's standard deviation to a number that is less than the weighted average of the stocks in the portfolio. Therefore, you can calculate the amount of risk that you were able to diversify away as the difference between the portfolio's risk and the weighted average of the risks of the stocks in it. Thus if the stocks have a weighted average risk of 35% and the actual risk of the portfolio is 25% (both of which you need to calculate for this problem), then diversification reduced your risk by 35%-25% = 10%. The correct answer is: 0.036

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts