Question: show how you got your answer with work! Use the following financial statement information to answer Questions 12-16. Amounts are in thousands of dollars (except

show how you got your answer with work!

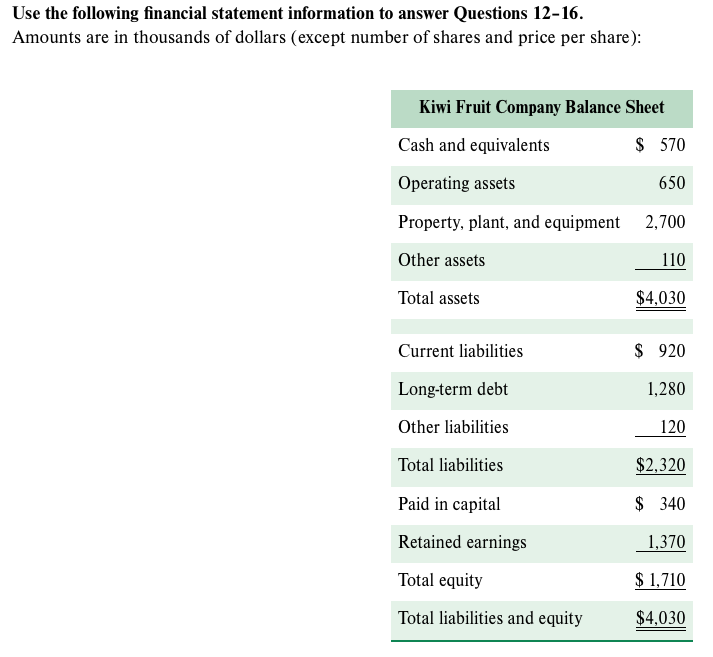

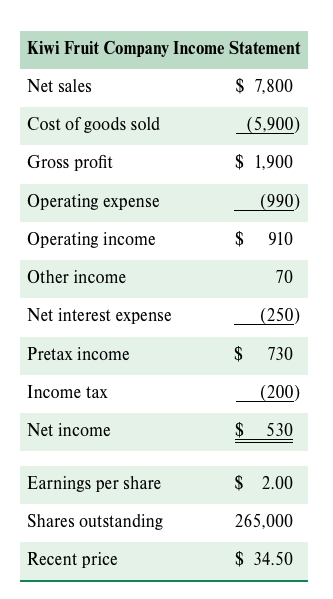

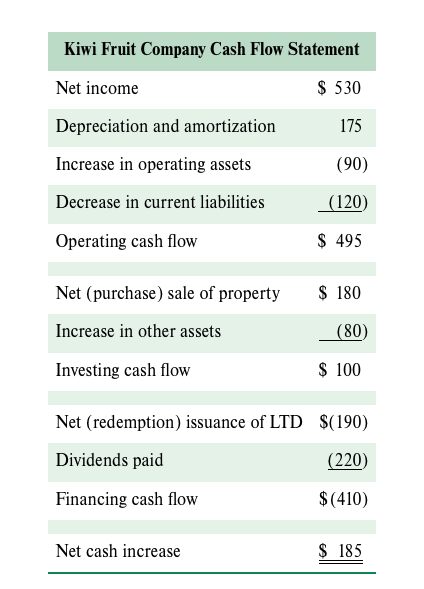

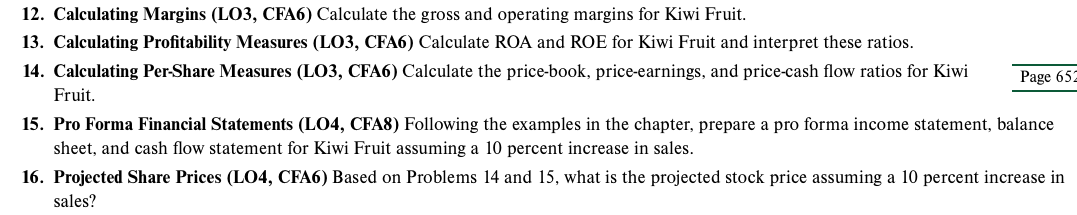

Use the following financial statement information to answer Questions 12-16. Amounts are in thousands of dollars (except number of shares and price per share): Kiwi Fruit Company Balance Sheet $ 570 Cash and equivalents Operating assets 650 Property, plant, and equipment 2,700 Other assets 110 Total assets $4,030 Current liabilities $ 920 Long-term debt 1,280 Other liabilities 120 Total liabilities $2,320 Paid in capital $ 340 Retained earnings 1,370 Total equity $ 1,710 Total liabilities and equity $4,030 Kiwi Fruit Company Income Statement Net sales $ 7,800 Cost of goods sold (5,900) Gross profit $ 1,900 Operating expense (990) Operating income $ 910 Other income 70 Net interest expense (250) Pretax income $ 730 Income tax (200) Net income $ 530 Earnings per share $ 2.00 Shares outstanding 265,000 Recent price $ 34.50 Kiwi Fruit Company Cash Flow Statement Net income $ 530 Depreciation and amortization 175 Increase in operating assets (90) Decrease in current liabilities (120) Operating cash flow $ 495 $ 180 Net (purchase) sale of property Increase in other assets (80) Investing cash flow $ 100 Net (redemption) issuance of LTD $(190) Dividends paid (220) Financing cash flow $(410) Net cash increase $ 185 12. Calculating Margins (LO3, CFA6) Calculate the gross and operating margins for Kiwi Fruit. 13. Calculating Profitability Measures (LO3, CFA6) Calculate ROA and ROE for Kiwi Fruit and interpret these ratios. 14. Calculating Per-Share Measures (LO3, CFA6) Calculate the price-book, price-earnings, and price-cash flow ratios for Kiwi Page 652 Fruit. 15. Pro Forma Financial Statements (L04, CFA8) Following the examples in the chapter, prepare a pro forma income statement, balance sheet, and cash flow statement for Kiwi Fruit assuming a 10 percent increase in sales. 16. Projected Share Prices (L04, CFA6) Based on Problems 14 and 15, what is the projected stock price assuming a 10 percent increase in sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts