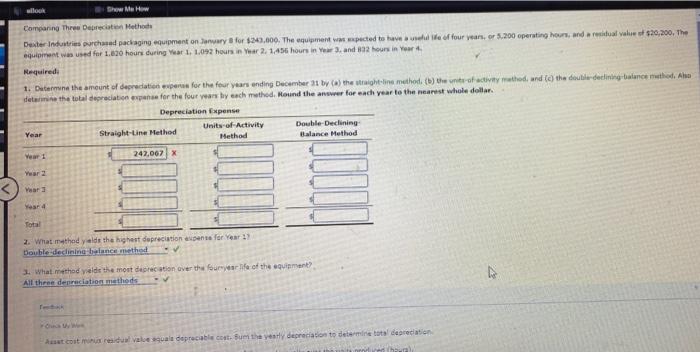

Question: Show Me How Comparing Three Dereciation Methode Dexter Industries purchased packaging equipment on January for $249,000. The equipment van wapected to have We of four

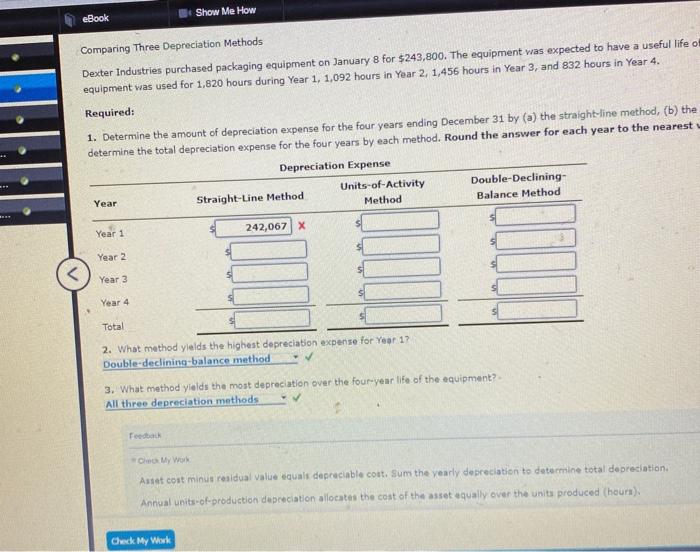

Show Me How Comparing Three Dereciation Methode Dexter Industries purchased packaging equipment on January for $249,000. The equipment van wapected to have We of four years, er 5.200 operating hours, and residual value $20,200. The equipment was used for 1.120 hours during Yar 1, 1,092 hours in Year 2. 1.456 hours in Year 3 and 32 hours in your Required 1. Dutermine the amount of depreciation expers for the four years ending December 31 by (a) the tight-line method (b) the unit of active method, and to the double declining balance method, the delam the total depreciation expense for the four years by each method. Hound the answer for each year to the nearest whole dollar Depreciation Expense Units of Activity Double Declining Year Straight-Line Method Method Balance Method 242,067 X Year 2 Vaata Yes Total 2. What method yield the highest depreciation agent for Year 19 Double declining balance method 1. What method yields the most deprecation over the four of the equipment All these depreciation methods cost muresidual va quale depreciable cost. Suen the early depreciation to determine total depreciation eBook Show Me How Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $243,800. The equipment was expected to have a useful life of equipment was used for 1,820 hours during Year 1, 1,092 hours in Year 2, 1,456 hours in Year 3, and 832 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest Depreciation Expense Units-of-Activity Double-Declining- Straight-Line Method Method Balance Method Year Year 1 242,067 X Year 2 Year 3 Year 4 Total 2. What method yields the highest depreciation expense for Year 17 Double-declining balance method 3. What method yields the most depreciation over the four-year life of the equipment? All three depreciation methods Feedback Chy Work Asset cost minus residual value equals depreciable cout. Sum the yearly depreciation to determine total depreciation. Annual units of production depreciation allocates the cost of the asset qually over the units produced (hourt). Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts