Question: Show me how the completed assignment would be, in excel form when needed too. I will upload a second photo of the assignment, couldn't fit

Show me how the completed assignment would be, in excel form when needed too. I will upload a second photo of the assignment, couldn't fit all in one.

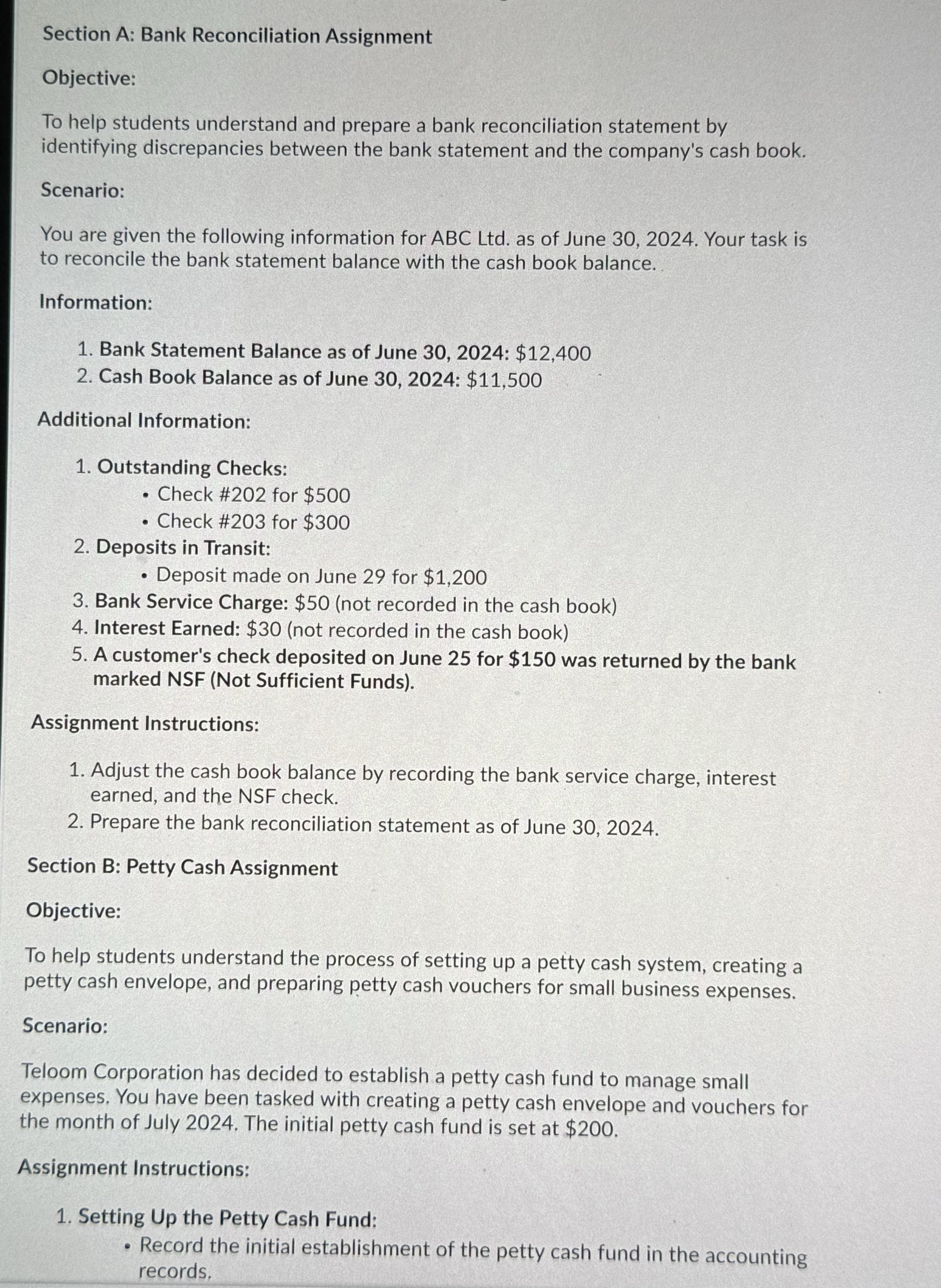

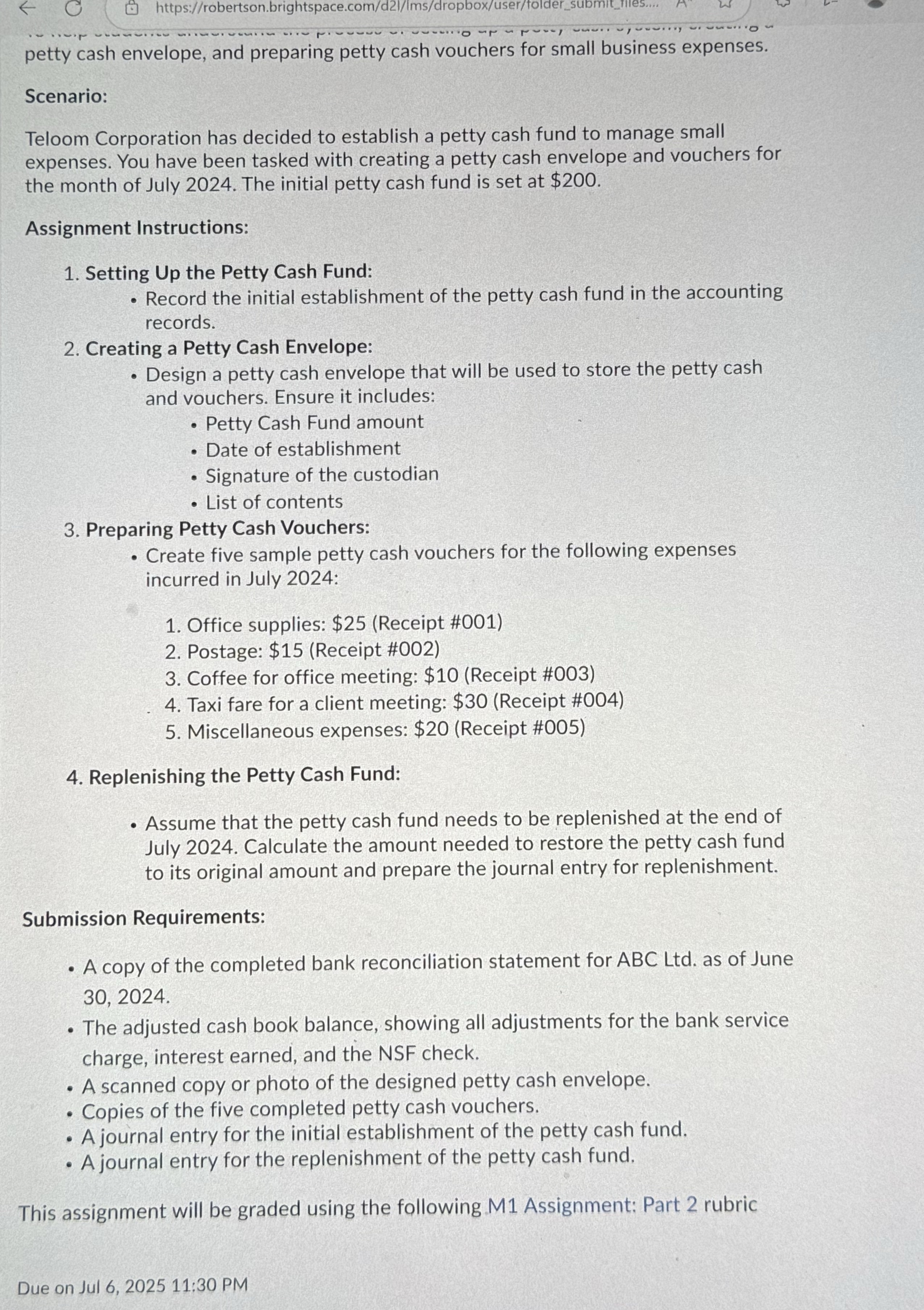

Section A: Bank Reconciliation Assignment Objective: To help students understand and prepare a bank reconciliation statement by identifying discrepancies between the bank statement and the company's cash book. Scenario: You are given the following information for ABC Ltd. as of June 30, 2024. Your task is to reconcile the bank statement balance with the cash book balance. Information: 1. Bank Statement Balance as of June 30, 2024: $12,400 2. Cash Book Balance as of June 30, 2024: $11,500 Additional Information: 1. Outstanding Checks: Check #202 for $500 Check #203 for $300 2. Deposits in Transit: Deposit made on June 29 for $1,200 3. Bank Service Charge: $50 (not recorded in the cash book) 4. Interest Earned: $30 (not recorded in the cash book) 5. Acustomer's check deposited on June 25 for $150 was returned by the bank marked NSF (Not Sufficient Funds). Assignment Instructions: 1. Adjust the cash book balance by recording the bank service charge, interest earned, and the NSF check. 2. Prepare the bank reconciliation statement as of June 30, 2024. Section B: Petty Cash Assignment Objective: To help students understand the process of setting up a petty cash system, creating a petty cash envelope, and preparing petty cash vouchers for small business expenses. Scenario: Teloom Corporation has decided to establish a petty cash fund to manage small expenses, You have been tasked with creating a petty cash envelope and vouchers for the month of July 2024, The initial petty cash fund is set at $200. Assignment Instructions: 1. Setting Up the Petty Cash Fund: + Record the initial establishment of the petty cash fund in the accounting records, https://robertson.brightspace.com/d21/Ims/dropbox/user/ petty cash envelope, and preparing petty cash vouchers for small business expenses. Scenario: Teloom Corporation has decided to establish a petty cash fund to manage small expenses. You have been tasked with creating a petty cash envelope and vouchers for the month of July 2024. The initial petty cash fund is set at $200. Assignment Instructions: 1. Setting Up the Petty Cash Fund: . Record the initial establishment of the petty cash fund in the accounting records. 2. Creating a Petty Cash Envelope: . Design a petty cash envelope that will be used to store the petty cash and vouchers. Ensure it includes: . Petty Cash Fund amount . Date of establishment . Signature of the custodian . List of contents 3. Preparing Petty Cash Vouchers: . Create five sample petty cash vouchers for the following expenses incurred in July 2024: 1. Office supplies: $25 (Receipt #001) 2. Postage: $15 (Receipt #002) 3. Coffee for office meeting: $10 (Receipt #003) 4. Taxi fare for a client meeting: $30 (Receipt #004) 5. Miscellaneous expenses: $20 (Receipt #005) 4. Replenishing the Petty Cash Fund: Assume that the petty cash fund needs to be replenished at the end of July 2024. Calculate the amount needed to restore the petty cash fund to its original amount and prepare the journal entry for replenishment. Submission Requirements: . A copy of the completed bank reconciliation statement for ABC Ltd. as of June 30, 2024. . The adjusted cash book balance, showing all adjustments for the bank service charge, interest earned, and the NSF check. . A scanned copy or photo of the designed petty cash envelope . Copies of the five completed petty cash vouchers. . A journal entry for the initial establishment of the petty cash fund. . A journal entry for the replenishment of the petty cash fund. This assignment will be graded using the following M1 Assignment: Part 2 rubric Due on Jul 6, 2025 11:30 PM