Question: Show me the steps to solve analyst at Aurora Fixed Income Management. Your team is evaluating a new corporate bond issue as a potential investment.

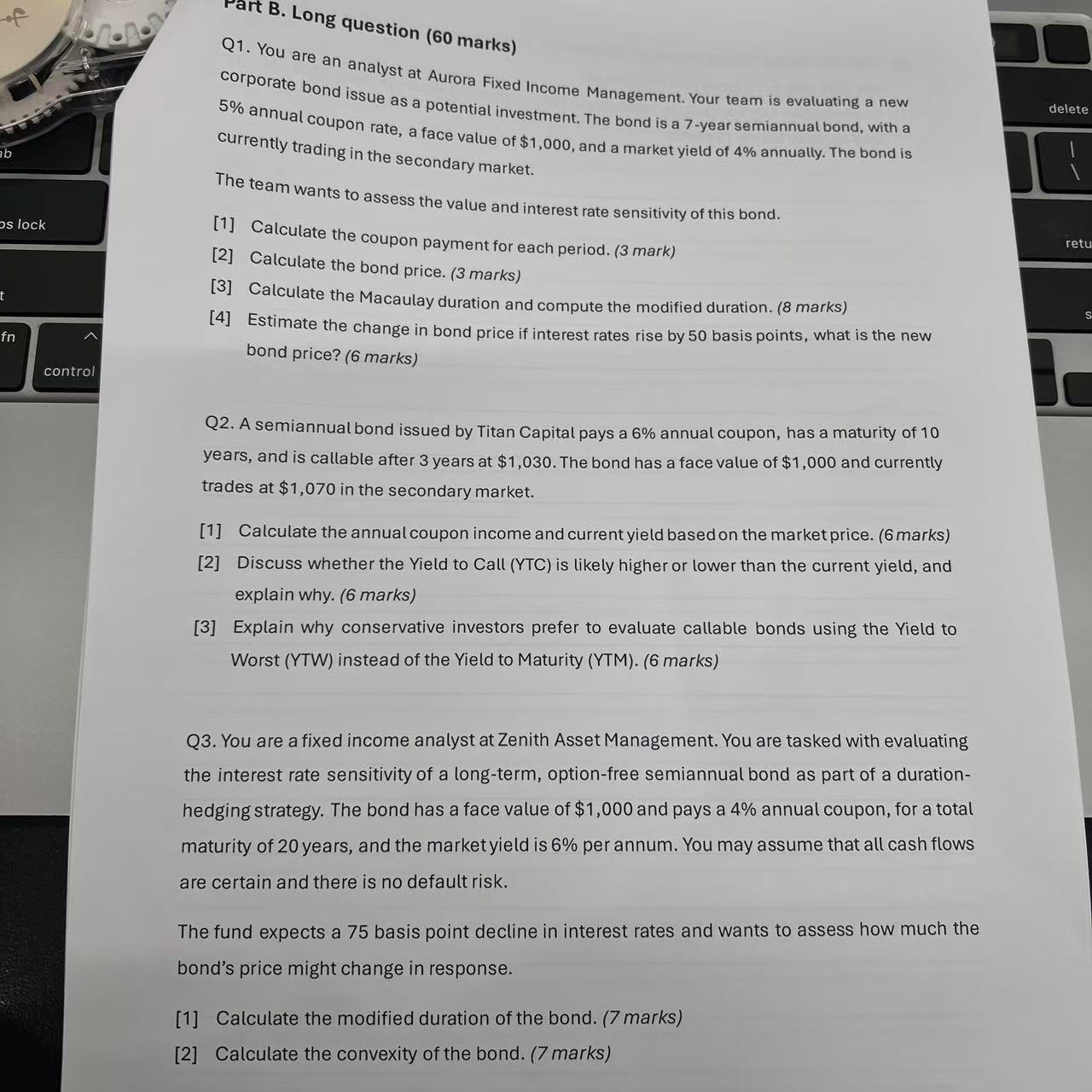

Show me the steps to solve analyst at Aurora Fixed Income Management. Your team is evaluating a new corporate bond issue as a potential investment. The bond is a year semiannual bond, with a annual coupon rate, a face value of $ and a market yield of annually. The bond is currently trading in the secondary market. The team wants to assess the value and interest rate sensitivity of this bond. Calculate the coupon payment for each period. mark Calculate the bond price. marks Calculate the Macaulay duration and compute the modified duration. marks Estimate the change in bond price if interest rates rise by basis points, what is the new bond price? marks Q A semiannual bond issued by Titan Capital pays a annual coupon, has a maturity of years, and is callable after years at $ The bond has a face value of $ and currently trades at $ in the secondary market. Calculate the annual coupon income and current yield based on the market price. marks Discuss whether the Yield to Call YTC is likely higher or lower than the current yield, and explain why. marks Explain why conservative investors prefer to evaluate callable bonds using the Yield to Worst YTW instead of the Yield to Maturity YTM marks Q You are a fixed income analyst at Zenith Asset Management. You are tasked with evaluating the interest rate sensitivity of a longterm, optionfree semiannual bond as part of a durationhedging strategy. The bond has a face value of $ and pays a annual coupon, for a total maturity of years, and the market yield is per annum. You may assume that all cash flows are certain and there is no default risk. The fund expects a basis point decline in interest rates and wants to assess how much the bond's price might change in response. Calculate the modified duration of the bond. marks Calculate the convexity of the bond. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock