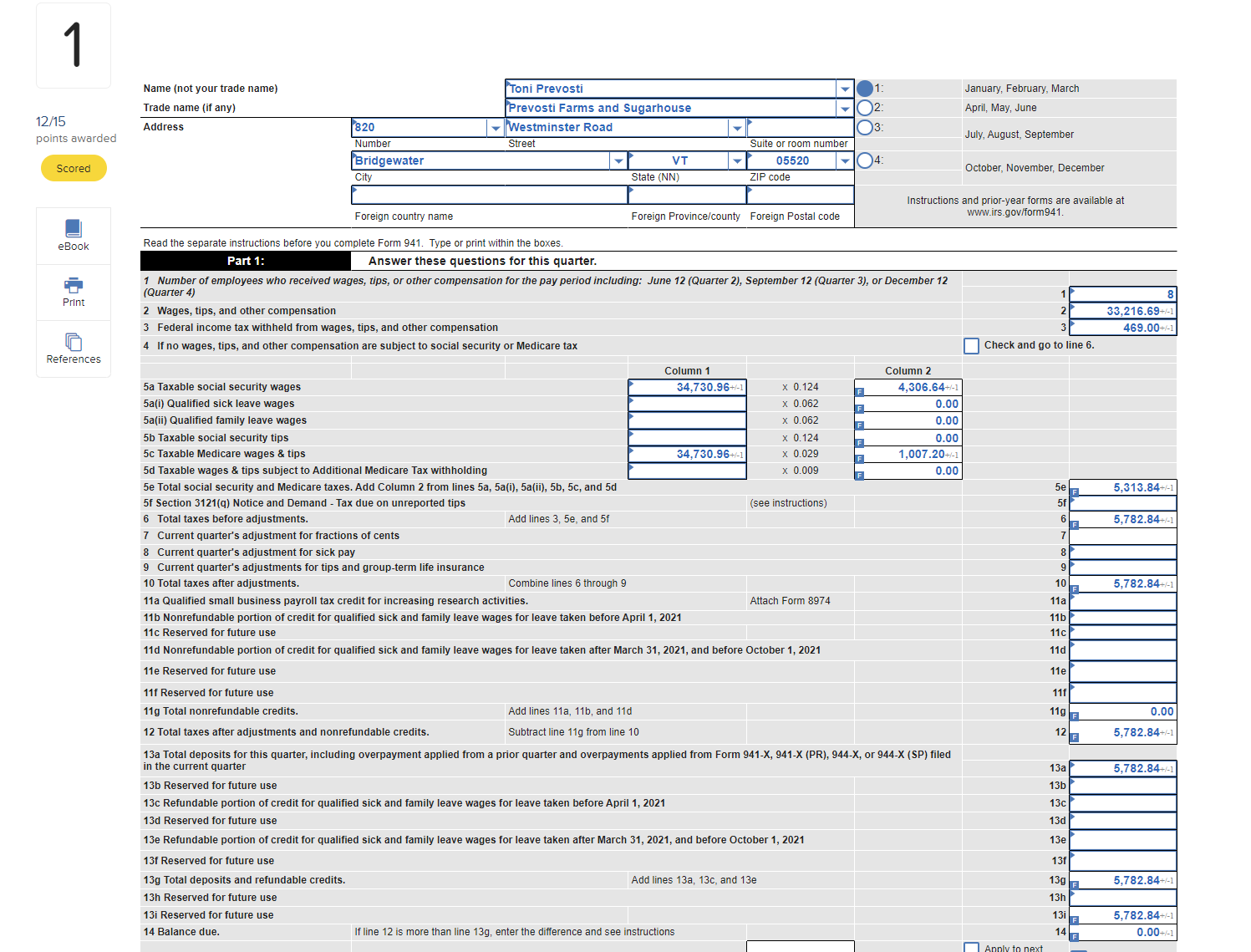

Question: Show me the steps to solve for line 2 on the quarterly tax form i dont know how $ 3 8 , 7 2 0

Show me the steps to solve for line on the quarterly tax form i dont know how $ turned into $ for wages tips and other compensation. Also for like a taxable wages. how did they get $ as the answer? correct answers shown in the image

other information:

The firstquarter tax return needs to be filed for Prevosti Farms and Sugarhouse by April For the taxes, assume the second February payroll amounts were duplicated for the March and March payroll periods, and the new benefit elections went into effect as planned. The form was completed and signed on April

Benefit Information Exempt

Federal FICA

Health Insurance Yes Yes

Life Insurance Yes Yes

Longterm Care Yes Yes

FSA Yes Yes

k Yes No

Gym No No

Owner's name Toni Prevosti

Address Westminster Road, Bridgewater, VT

Phone

Number of employees

Gross quarterly wages exclusive of fringe benefits $

Federal income tax withheld $

k contributions $

Section withheld $

Gym Membership add to all taxable wages, not included above $

Month Deposit $

Month Deposit $

Month Deposit $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock