Question: Show me the steps to solve GROUP CASE STUDY - Post and Sage EXHIBIT 1 : Calculation and amortization of acquisition differential SPECIFIC INSTRUCTIONS: Only

Show me the steps to solve

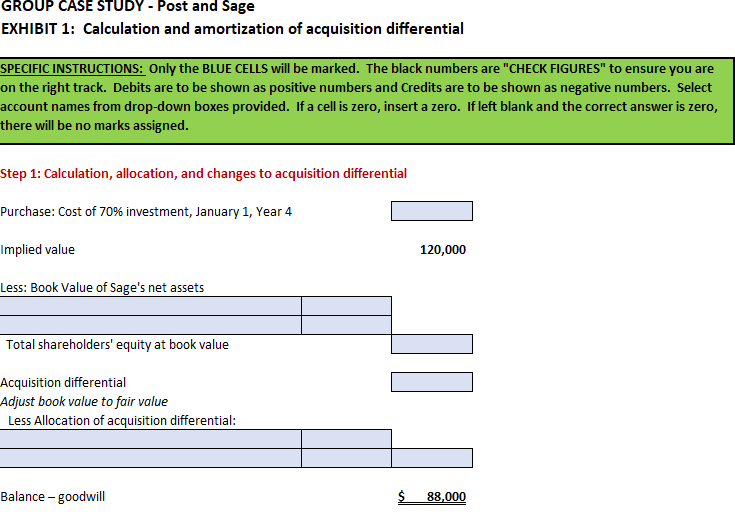

GROUP CASE STUDY Post and Sage

EXHIBIT : Calculation and amortization of acquisition differential

SPECIFIC INSTRUCTIONS: Only the BLUE CELLS will be marked. The black numbers are "CHECK FIGURES" to ensure you are

on the right track. Debits are to be shown as positive numbers and Credits are to be shown as negative numbers. Select

account names from dropdown boxes provided. If a cell is zero, insert a zero. If left blank and the correct answer is zero,

there will be no marks assigned.

Step : Calculation, allocation, and changes to acquisition differential

Purchase: Cost of investment, January Year

Less: Book Value of Sage's net assets

Total shareholders' equity at book value

Acquisition differential

Adjust book value to fair value

Less Allocation of acquisition differential:

Balance goodwill

Step : Amortization of the Acquisition Differential Schedule

Inventory

Warehouse see note A below

Goodwill

Note A Show the formula calculation for the annual warehouse amortization

using this format: amountuseful life. The response must show the math. Do

not include $ Negative numbers are to be shown with a ignore any commas.

For example, inventory would read:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock