Question: Show me the steps to solve Question 2 ( 2 5 p ) d ) Calculate the undiversified VaR and the monetary gains from diversification

Show me the steps to solve Question p d Calculate the undiversified VaR and the monetary gains from diversification based on both

the relative exercise b and absolute exercise c parametric valueatrisk for the individual

stocks and for the portfolio, respectively. Explain the difference in results between using

the relative versus absolute VaR models. p

Absolute VaR is lower than the relative VaR for the individual stocks and the portfolio.

The reason is due to the positive expected returns for each stock and for the portfollio.

e Over the last months you observe that the daily observed losses in your portfolio is

greater than that predicted by your model on days. Are you satisfied with your

estimates of predicted risk? Motivate your answer. p

No Z Reject null hypothesis that VaR is working well at the level. It fails too

few times! Risk is not captured in an appropriate way!

f Over the last months, what is the largest number of failures of de ie number

of times the actual loss is larger than that predicted by that could be acceptable

without rejecting the tar model? p

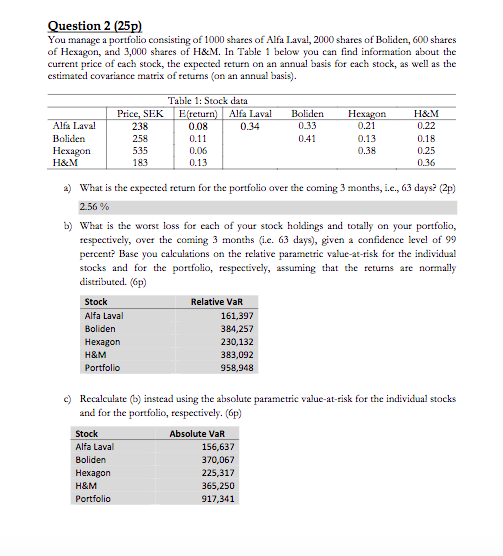

You manage a portfolio consisting of shares of Alfa Laval, shares of Boliden, shares

of Hexagon, and shares of H&M In Table below you can find information about the

current price of each stock, the expected return on an annual basis for each stock, as well as the

estimated covatiance matrix of returns on an annual basis

a What is the expected return for the portfolio over the coming months, ie days? p

b What is the worst loss for each of your stock holdings and totally on your portfolio,

respectively, over the coming months ie days given a confidence level of

percent? Base you calculations on the relative parametric valueatrisk for the individual

stocks and for the portfolio, respectively, assuming that the returns are normally

distributed. p

c Recalculate b instead using the absolute parametric valueatrisk for the individual stocks

and for the portfolio, respectively. Gp

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock