Question: Show me the steps to solve Table A below shows abbreviated balance sheets for the central bank in the country of Beckland and B shows

Show me the steps to solve

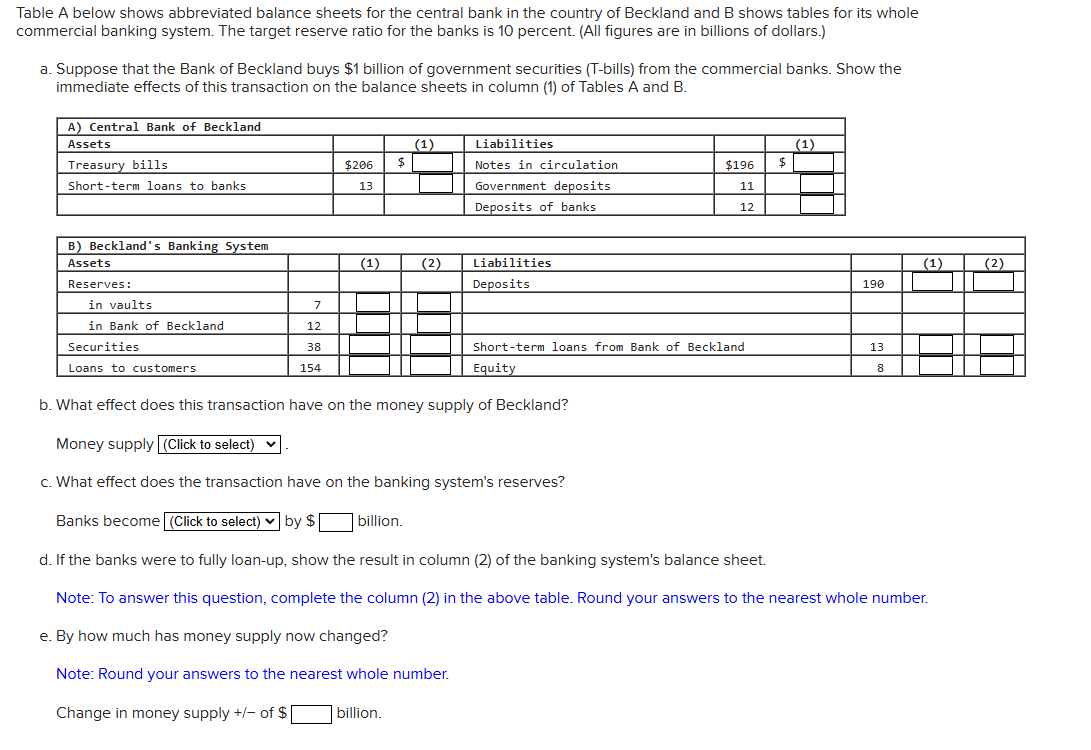

Table A below shows abbreviated balance sheets for the central bank in the country of Beckland and B shows tables for its whole

commercial banking system. The target reserve ratio for the banks is percent. All figures are in billions of dollars.

a Suppose that the Bank of Beckland buys $ billion of government securities Tbills from the commercial banks. Show the

immediate effects of this transaction on the balance sheets in column of Tables A and B

b What effect does this transaction have on the money supply of Beckland?

Money supply

c What effect does the transaction have on the banking system's reserves?

Banks become

by $

billion.

d If the banks were to fully loanup show the result in column of the banking system's balance sheet.

Note: To answer this question, complete the column in the above table. Round your answers to the nearest whole number.

e By how much has money supply now changed?

Note: Round your answers to the nearest whole number.

Change in money supply of $

billion.

Please fill the table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock