Question: Show me the steps to solve this case: Muriel Khan, CPA is what the diploma hanging on the wall says in bold print. As the

Show me the steps to solve this case:

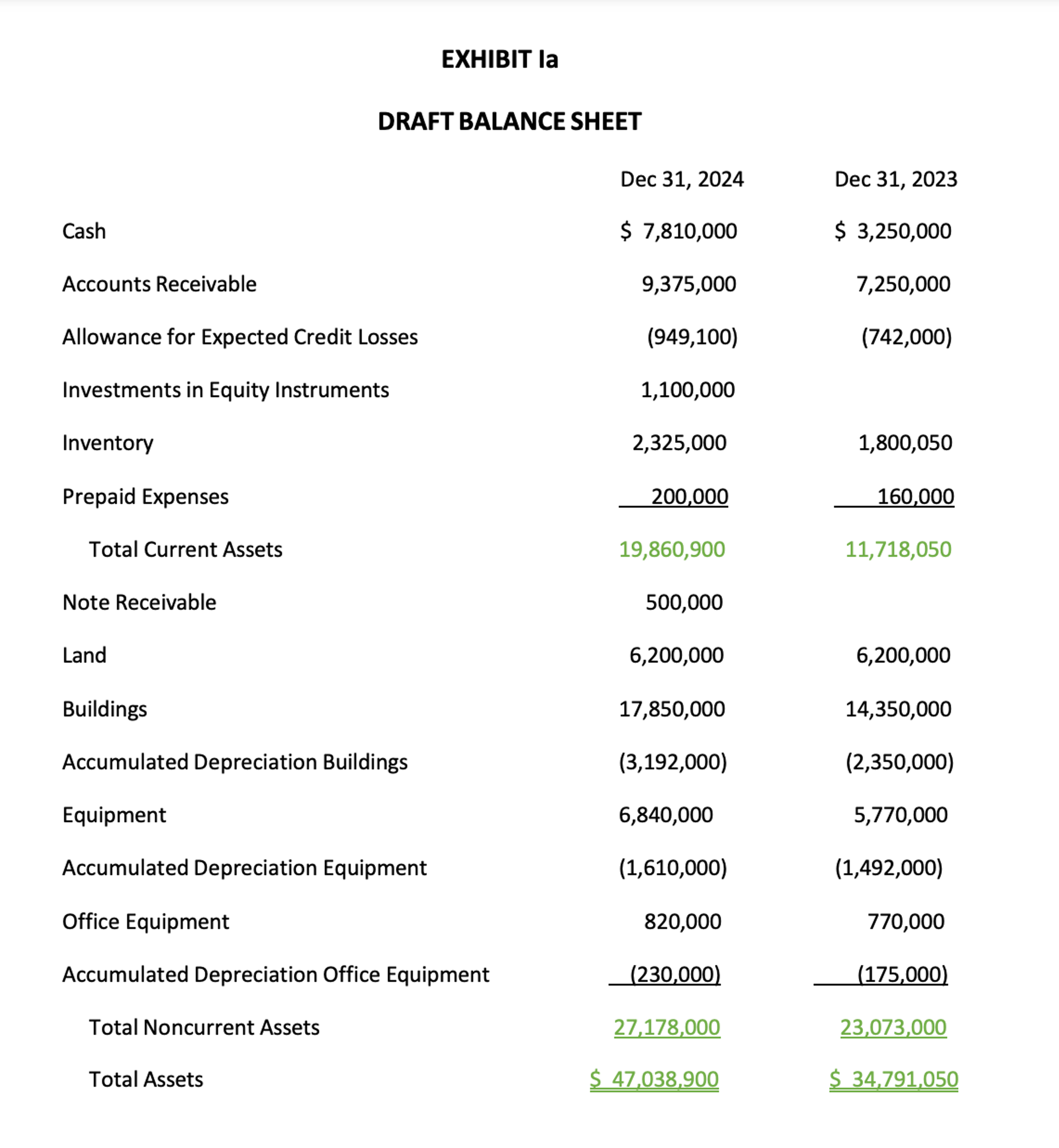

Muriel Khan, CPA is what the diploma hanging on the wall says in bold print. As the new Controller for Healey Industries, Muriel has been preparing for her inaugural Executive Committee meeting. She has prepared the draft yearend financial statements under the Accounting Standards for Private Enterprise Exhibit I for the meeting, hoping to make a good first impression. As Ms Khan enters the Boardroom, it appears all members of the Executive team are present. Bart Healey, the Chief Executive Officer calls the meeting together and welcomes Muriel to her first meeting. Welcome to our December Executive Committee meeting, our final meeting before our company yearend. Lets start with a sales update from our VicePresident, Sales Abagail Sycamore.Thanks Bart. I am pleased to announce that we have closed the sale to Finest Industries Limited. The final invoice amount was $ for units providing a margin of on our cost. The customer has asked us to ship the first units and hold the other units until they provide shipping instructions early next year when they have warehouse capacity. We have the full allotment of product ready to ship when instructed.Thanks Abagail and congratulations to you and your team. This sale has made a significant impact on the year end statements Muriel has prepared. Muriel, could you look into the issues around the recording of this sale and ensure the transaction is properly recognized in our current fiscal year financial statements. Abagail, anything else?Yes Bart, I have another transaction to announce. After months of negotiations, Anchor Commodities Inc. has placed their first order for $ with our normal gross profit margin. We have invoiced the sale and extended the payment terms to days from our normal days. This coincides with a special term in the contract which provides for Anchor to return any and all products within the day period. We have never had a contract term of this nature but I suspect it will be something we are asked for more in the future.Thanks Abagail.Next on the agenda, Bill Sparkes. How are we doing on the sale of the Apex division?Bart we have managed to isolate the financial performance of this division as well as a listing of assets that can not be redeployed in our ongoing operations Exhibit II Our consultants do not believe there is a market for Apex as a business and the equipment and furniture and fixtures will have nominal value. The consultants believe the assets Land and Building will sell within the next months.Thanks Bill. This division has been a drain on our earnings for too long now. Muriel, could you investigate how this should be presented in our yearend financial statements and report back for our January meeting?Muriel the next agenda item is mine and I believe it will impact you directly. I have been reviewing the preliminary divisional results and something struck me as unusual. The expenses when compared to last year for the Mason division appear to be high. I know the divisional accountant has left and to date has not been replaced. I am hoping you can review the schedule of expenses Exhibit III and notes provided by the Division Manager and make any adjustments you deem necessary.No problem Mr Healey.Muriel in this meeting call me Bart please!I think that is everything unless anyone else has anything else to present. At that point the hand belonging to Abhey Singh Patel was raised. I want to bring to everyones attention that we are having the new A grinding machine installed next week. This machine had a cost of $ which was approved at our September meeting. What was not discussed was the financing we arranged. A year noninterest bearing note saving the company $ in interest based on the quoted bank rate we received.Abhey well done. You and your team are to be commended.Muriel as you prepare your report, please keep in mind that our bank will be monitoring our financial statements with particular attention on maintaining our debttoequity ratio of : With that in mind, please limit your focus to the current years financial statements. Also, if you can include a couple of visualizations that may help the Committee better understand the impact of any proposed adjustments, that would be great.I think that is all for now. All the best to you and your families during the holiday season. Hopefully Muriel will have good news for our January meeting. EXHIBIT Ib

DRAFT STATEMENT OF INCOME EXHIBIT III

EXTRACTED FINANCIAL INFORMATION

NOTES

Product received from a supplier costing $ was shipped FOB shipping point and has been included in the physical inventory. The invoice for the goods was received and recorded in January

A payment of $ to the bondholder was recorded as interest expense. The payment represented a principal paym EXHIBIT II

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock