Question: Show solution answer for problem 123 with solution 1. Padrene Corp. wants to calculate its weighted average cost of capital. The company's CFO has collected

Show solution answer for problem 123 with solution

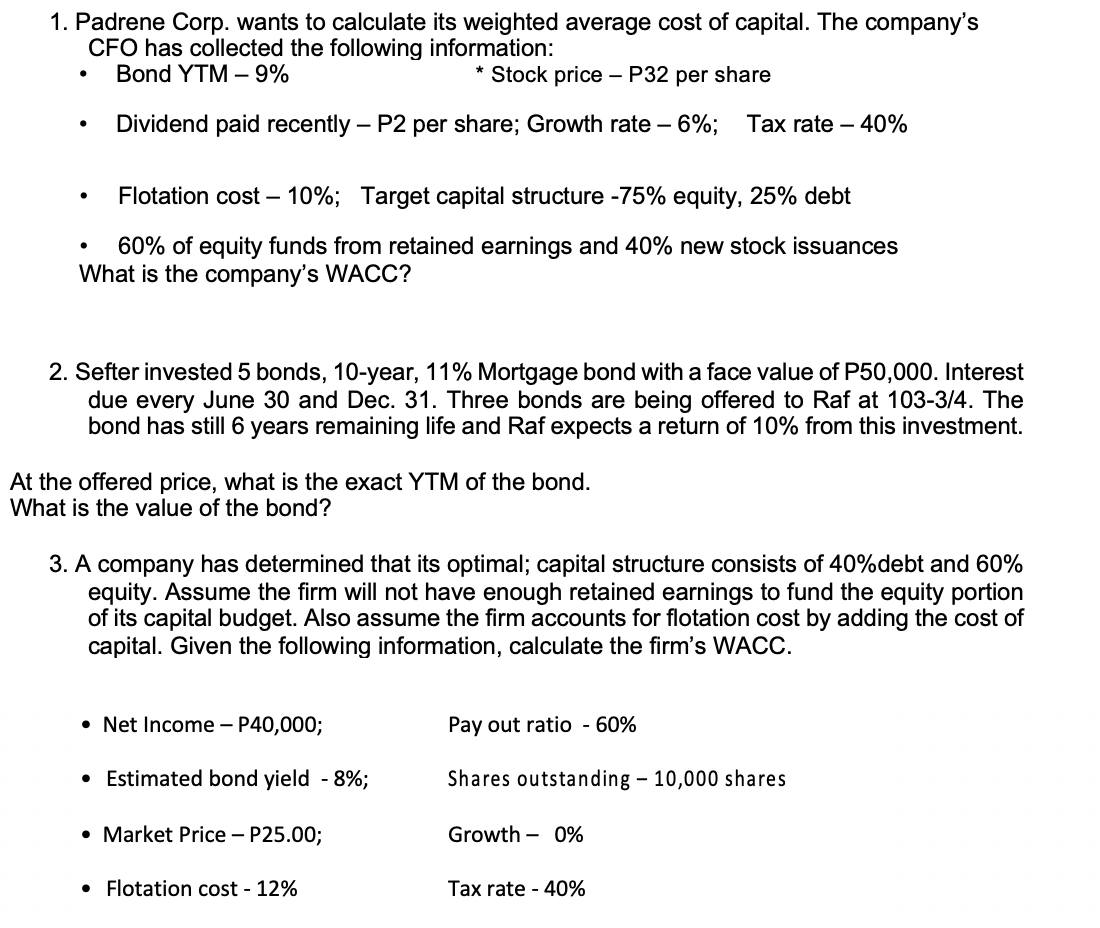

1. Padrene Corp. wants to calculate its weighted average cost of capital. The company's CFO has collected the following information: - Bond YTM 9% * Stock price - P32 per share - Dividend paid recently - P2 per share; Growth rate 6%; Tax rate 40% - Flotation cost - 10\%; Target capital structure 75% equity, 25% debt - 60% of equity funds from retained earnings and 40% new stock issuances What is the company's WACC? 2. Sefter invested 5 bonds, 10-year, 11% Mortgage bond with a face value of P50,000. Interest due every June 30 and Dec. 31. Three bonds are being offered to Raf at 103-3/4. The bond has still 6 years remaining life and Raf expects a return of 10% from this investment. It the offered price, what is the exact YTM of the bond. What is the value of the bond? 3. A company has determined that its optimal; capital structure consists of 40% debt and 60% equity. Assume the firm will not have enough retained earnings to fund the equity portion of its capital budget. Also assume the firm accounts for flotation cost by adding the cost of capital. Given the following information, calculate the firm's WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts