Question: SHOW SOLUTION IN EXCEL. For 'a', use QM or Treeplan AND analytic solver. 9.22 REFERENCE 9.21 REFERENCE R9.23.- Reconsider Problem 9.22. The management of Silicon

SHOW SOLUTION IN EXCEL. For 'a', use QM or Treeplan AND analytic solver.

9.22 REFERENCE

9.21 REFERENCE

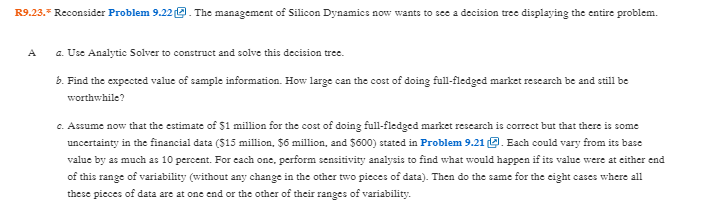

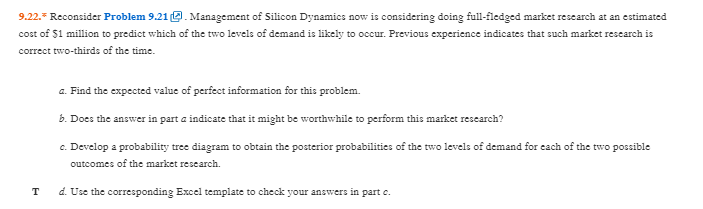

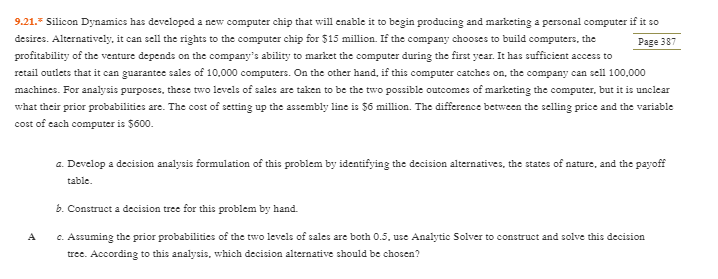

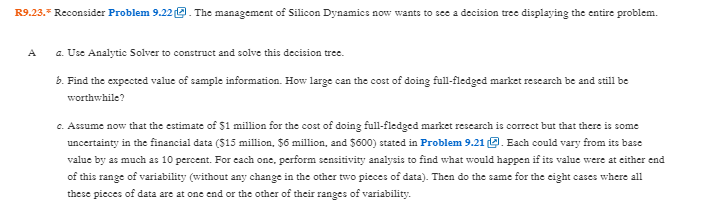

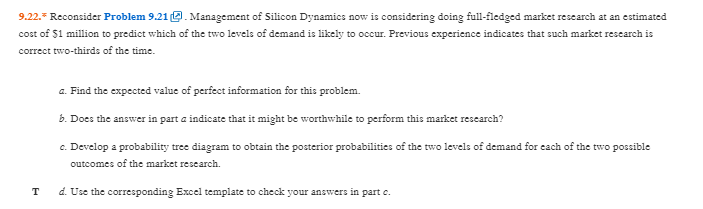

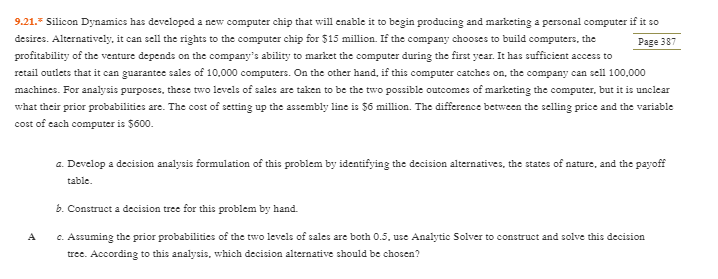

R9.23.- Reconsider Problem 9.22. The management of Silicon Dynamics now wants to see a decision tree displaying the entire problem. 4. Use Analytic Solver to construct and solve this decision tree. b. Find the expected value of sample information. How large can the cost of doing full-fledged market research be and still be worthwhile? c. Assume now that the estimate of $1 million for the cost of doing full-fledged market research is correct but that there is some uncertainty in the financial data (515 million, 56 million, and 5600) stated in Problem 9.21 . Each could vary from its base value by as much as 10 percent. For each one, perform sensitivity analysis to find what would happen if its value were at either end of this range of variability (without any change in the other two pieces of data). Then do the same for the eight cases where all these pieces of data are at one end or the other of their ranges of variability. 9.22.- Reconsider Problem 9.212. Management of Silicon Dynamics now is considering doing full-fledged market research at an estimated cost of $1 million to predict which of the two levels of demand is likely to occur. Previous experience indicates that such market research is correct two-thirds of the time. 2. Find the expected value of perfect information for this problem. b. Does the answer in part a indicate that it might be worthwhile to perform this market research? c. Develop a probability tree diagram to obtain the posterior probabilities of the two levels of demand for each of the two possible outcomes of the market research. T d. Use the corresponding Excel template to check your answers in part c. 9.21.* Silicon Dynamics has developed a new computer chip that will enable it to begin producing and marketing a personal computer if it so desires. Alternatively, it can sell the rights to the computer chip for $15 million. If the company chooses to build computers, the Page 387 profitability of the venture depends on the company's ability to market the computer during the first year. It has sufficient access to retail outlets that it can guarantee sales of 10,000 computers. On the other hand, if this computer catches on the company can sell 100.000 machines. For analysis purposes, these two levels of sales are taken to be the two possible outcomes of marketing the computer, but it is unclear what their prior probabilities are. The cost of setting up the assembly line is 56 million. The difference between the selling price and the variable cost of each computer is 5600. 4. Develop a decision analysis formulation of this problem by identifying the decision alternatives, the states of nature, and the payoff table. b. Construct a decision tree for this problem by hand. C. Assuming the prior probabilities of the two levels of sales are both 0.5. use Analytic Solver to construct and solve this decision tree. According to this analysis, which decision alternative should be chosen? R9.23.- Reconsider Problem 9.22. The management of Silicon Dynamics now wants to see a decision tree displaying the entire problem. 4. Use Analytic Solver to construct and solve this decision tree. b. Find the expected value of sample information. How large can the cost of doing full-fledged market research be and still be worthwhile? c. Assume now that the estimate of $1 million for the cost of doing full-fledged market research is correct but that there is some uncertainty in the financial data (515 million, 56 million, and 5600) stated in Problem 9.21 . Each could vary from its base value by as much as 10 percent. For each one, perform sensitivity analysis to find what would happen if its value were at either end of this range of variability (without any change in the other two pieces of data). Then do the same for the eight cases where all these pieces of data are at one end or the other of their ranges of variability. 9.22.- Reconsider Problem 9.212. Management of Silicon Dynamics now is considering doing full-fledged market research at an estimated cost of $1 million to predict which of the two levels of demand is likely to occur. Previous experience indicates that such market research is correct two-thirds of the time. 2. Find the expected value of perfect information for this problem. b. Does the answer in part a indicate that it might be worthwhile to perform this market research? c. Develop a probability tree diagram to obtain the posterior probabilities of the two levels of demand for each of the two possible outcomes of the market research. T d. Use the corresponding Excel template to check your answers in part c. 9.21.* Silicon Dynamics has developed a new computer chip that will enable it to begin producing and marketing a personal computer if it so desires. Alternatively, it can sell the rights to the computer chip for $15 million. If the company chooses to build computers, the Page 387 profitability of the venture depends on the company's ability to market the computer during the first year. It has sufficient access to retail outlets that it can guarantee sales of 10,000 computers. On the other hand, if this computer catches on the company can sell 100.000 machines. For analysis purposes, these two levels of sales are taken to be the two possible outcomes of marketing the computer, but it is unclear what their prior probabilities are. The cost of setting up the assembly line is 56 million. The difference between the selling price and the variable cost of each computer is 5600. 4. Develop a decision analysis formulation of this problem by identifying the decision alternatives, the states of nature, and the payoff table. b. Construct a decision tree for this problem by hand. C. Assuming the prior probabilities of the two levels of sales are both 0.5. use Analytic Solver to construct and solve this decision tree. According to this analysis, which decision alternative should be chosen