Question: show solutions in excel Question 24 (12 points) Consider a one-period binomial world in which the current stock price of $92 can either go up

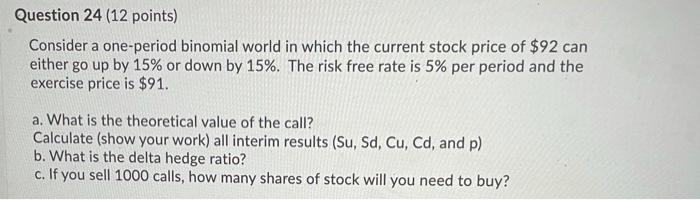

Question 24 (12 points) Consider a one-period binomial world in which the current stock price of $92 can either go up by 15% or down by 15%. The risk free rate is 5% per period and the exercise price is $91. a. What is the theoretical value of the call? Calculate (show your work) all interim results (Su, Sd, Cu, Cd, and p) b. What is the delta hedge ratio? c. If you sell 1000 calls, how many shares of stock will you need to buy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts