Question: Show step by step calculations for part (ii) Suppose the expected return on the market portfolio equals 12%. The current risk-free rate is 4%. The

Show step by step calculations for part (ii)

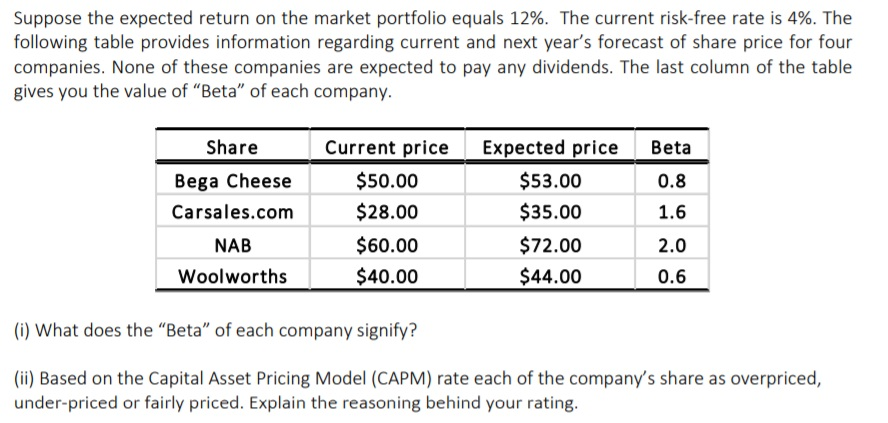

Suppose the expected return on the market portfolio equals 12%. The current risk-free rate is 4%. The following table provides information regarding current and next year's forecast of share price for four companies. None of these companies are expected to pay any dividends. The last column of the table gives you the value of "Beta" of each company. Share Current price $50.00 $28.00 $60.00 $40.00 Bega Cheese Carsales.com NAB Woolworths Expected price $53.00 $35.00 $72.00 $44.00 Beta 0.8 1.6 2.0 0.6 (i) What does the "Beta" of each company signify? (ii) Based on the Capital Asset Pricing Model (CAPM) rate each of the company's share as overpriced, under-priced or fairly priced. Explain the reasoning behind your rating

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts