Question: Show step by step solution and explain Stock ABC has the following characteristics: The current price to buy one share is 100. The stock does

Show step by step solution and explain

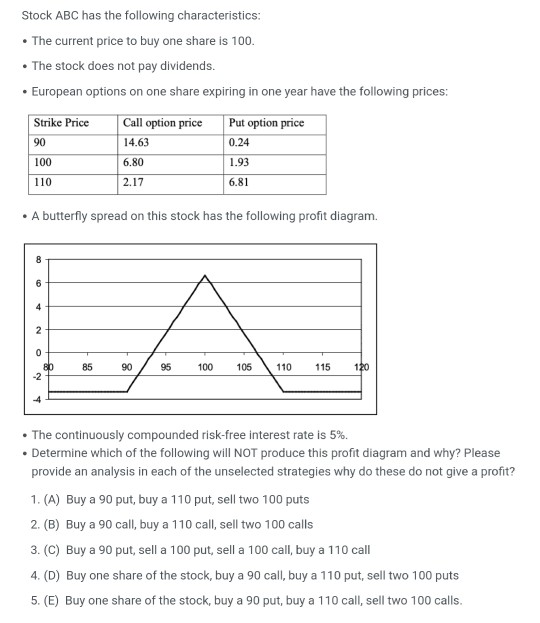

Stock ABC has the following characteristics: The current price to buy one share is 100. The stock does not pay dividends. European options on one share expiring in one year have the following prices: Strike Price 90 Call option price 14.63 Put option price 0.24 100 6.80 1.93 110 2.17 6.81 A butterfly spread on this stock has the following profit diagram. 8 6 4 2 0 80 -2 85 90 95 100 105 110 115 120 The continuously compounded risk-free interest rate is 5%. Determine which of the following will NOT produce this profit diagram and why? Please provide an analysis in each of the unselected strategies why do these do not give a profit? 1. (A) Buy a 90 put, buy a 110 put, sell two 100 puts 2. (B) Buy a 90 call, buy a 110 call, sell two 100 calls 3. (C) Buy a 90 put, sell a 100 put, sell a 100 call, buy a 110 call 4. (D) Buy one share of the stock, buy a 90 call, buy a 110 put, sell two 100 puts 5. (E) Buy one share of the stock, buy a 90 put, buy a 110 call, sell two 100 calls. Stock ABC has the following characteristics: The current price to buy one share is 100. The stock does not pay dividends. European options on one share expiring in one year have the following prices: Strike Price 90 Call option price 14.63 Put option price 0.24 100 6.80 1.93 110 2.17 6.81 A butterfly spread on this stock has the following profit diagram. 8 6 4 2 0 80 -2 85 90 95 100 105 110 115 120 The continuously compounded risk-free interest rate is 5%. Determine which of the following will NOT produce this profit diagram and why? Please provide an analysis in each of the unselected strategies why do these do not give a profit? 1. (A) Buy a 90 put, buy a 110 put, sell two 100 puts 2. (B) Buy a 90 call, buy a 110 call, sell two 100 calls 3. (C) Buy a 90 put, sell a 100 put, sell a 100 call, buy a 110 call 4. (D) Buy one share of the stock, buy a 90 call, buy a 110 put, sell two 100 puts 5. (E) Buy one share of the stock, buy a 90 put, buy a 110 call, sell two 100 calls

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts