Question: show step by step work and explanation for choice Which of the following statements is false? A. Floating rate bonds have less price risk than

show step by step work and explanation for choice

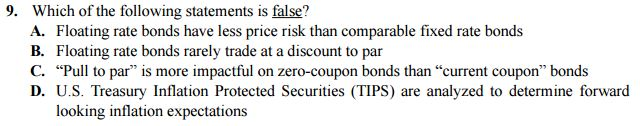

Which of the following statements is false? A. Floating rate bonds have less price risk than comparable fixed rate bonds B. Floating rate bonds rarely trade at a discount to par C. "Pull to par" is more impactful on zero-coupon bonds than "current coupon" bonds D. U.S. Treasury Inflation Protected Securities (TIPS) are analyzed to determine forward looking inflation expectations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts