Question: Show step-by-step. need help asap! ty (Capital Asset Pricing Model) Johnson Manufacturing, Inc., is considering several investments. The rate on Treasury bills is currently 6

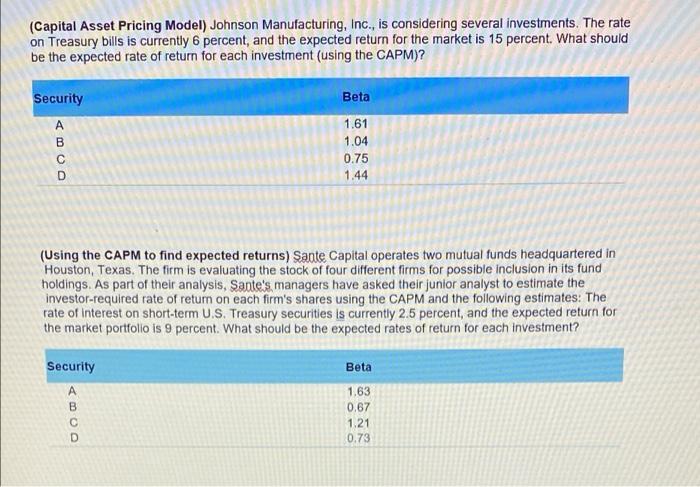

(Capital Asset Pricing Model) Johnson Manufacturing, Inc., is considering several investments. The rate on Treasury bills is currently 6 percent, and the expected return for the market is 15 percent. What should be the expected rate of return for each investment (using the CAPM)? Security COO B D Beta 1.61 1.04 0.75 1.44 (Using the CAPM to find expected returns) Sante Capital operates two mutual funds headquartered in Houston, Texas. The firm is evaluating the stock of four different firms for possible inclusion in its fund holdings. As part of their analysis, Sante's managers have asked their junior analyst to estimate the investor-required rate of return on each firm's shares using the CAPM and the following estimates: The rate of interest on short-term U.S. Treasury securities is currently 2.5 percent, and the expected return for the market portfolio is 9 percent. What should be the expected rates of return for each investment? Security Beta A B 1.63 0.67 1.21 0.73

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts