Question: show steps 4. (31 points) Given the financial statements for Dolphin Industrial, calculate the free cash flow from both an operating and financing perspective for

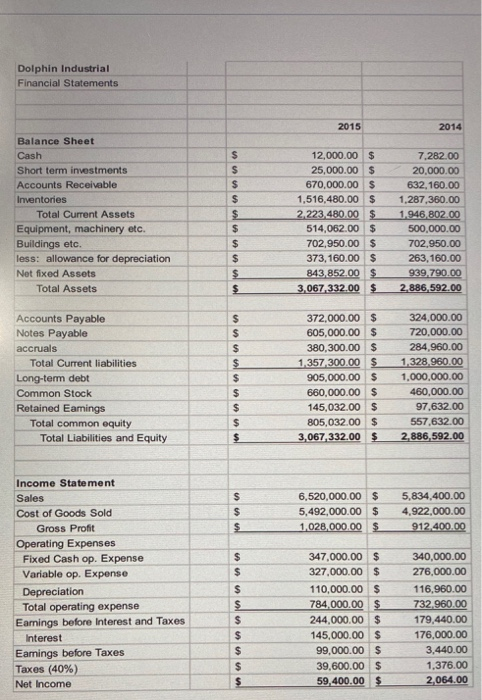

4. (31 points) Given the financial statements for Dolphin Industrial, calculate the free cash flow from both an operating and financing perspective for the year 2015. Dolphin Industrial Financial Statements 2015 2014 Balance Sheet Cash Short term investments Accounts Receivable Inventories Total Current Assets Equipment, machinery etc. Buildings etc. less: allowance for depreciation Not fixed Assets Total Assets 12,000.00 $ 25,000.00 $ 670,000.00 $ 1,516,480.00 $ 2 223 480.00 $ 514,062.00 $ 702,950.00 $ 373, 160.00 $ 843,852.00 $ 3,067332.00 $ 7.282.00 20,000.00 632,160.00 1,287,360.00 1.946,802.00 500,000.00 702,950.00 263,160.00 939.790.00 2.886,592.00 ol Accounts Payable Notes Payable accruals Total Current liabilities Long-term debt Common Stock Retained Eamings Total common equity Total Liabilities and Equity 372,000.00 $ 605,000.00 $ 380,300.00 $ 1,357,300.00 $ 905,000.00 $ 660,000.00 $ 145,032.00 $ 805,032.00 $ 3,067,332.00 $ 324,000.00 720,000.00 284,960.00 1.328,960.00 1.000.000.00 460,000.00 97,632.00 557,632.00 2.886,592.00 6.520,000.00 $ 5,492,000.00 $ 1,028,000.00 $ 5,834,400.00 4.922,000.00 912.400.00 Income Statement Sales Cost of Goods Sold Gross Profit Operating Expenses Fixed Cash op. Expense Variable op. Expense Depreciation Total operating expense Earnings before Interest and Taxes Interest Earnings before Taxes Taxes (40%) Net Income 347,000.00 $ 327,000.00 $ 110,000.00 $ 784,000.00 $ 244,000.00 $ 145,000.00 $ 99,000.00 $ 39,600.00 $ 59,400.00 $ 340,000.00 276,000.00 116,960.00 732.960.00 179,440.00 176,000.00 3.440.00 1,376.00 2,064.00 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts