Question: show steps 4. John is saving for retirement at age 65. He doesn't know if he should save in three large lumps, or in equal

show steps

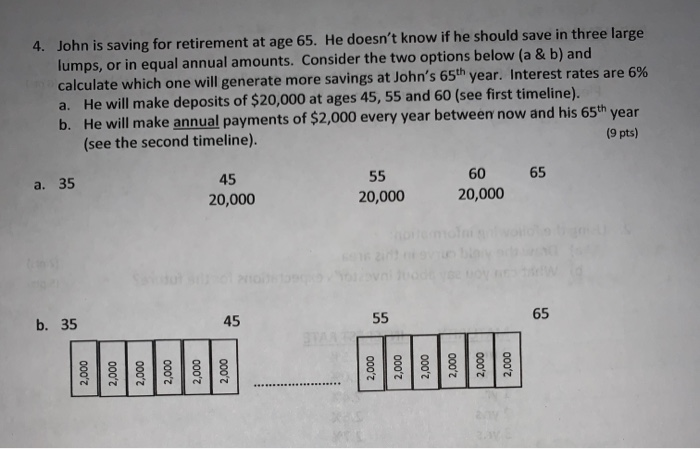

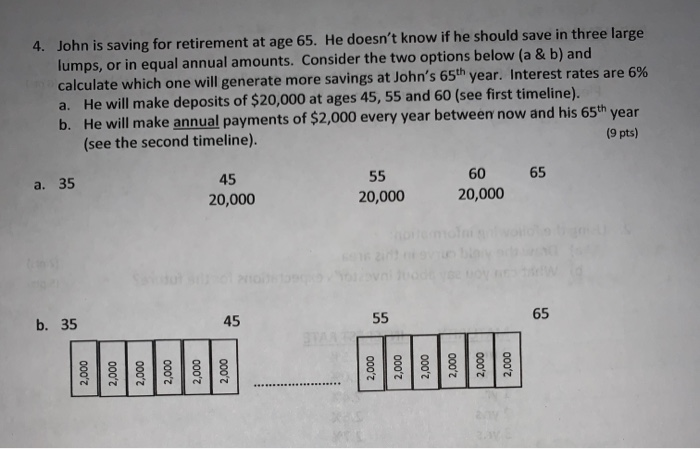

4. John is saving for retirement at age 65. He doesn't know if he should save in three large lumps, or in equal annual amounts. Consider the two options below (a & b) and calculate which one will generate more savings at John's 65th year. Interest rates are 6% a. He will make deposits of $20,000 at ages 45, 55 and 60 (see first timeline). b. He will make annual payments of $2,000 every year between now and his 65th year (see the second timeline). (9 pts) a. 35 45 20,000 55 20,000 6065 20,000 b. 35 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock