Question: Show steps and reason behind the answer please. The Mesa Corporation had net operating income of $380,000 and average operating assets of $2,000,000. The corporation's

Show steps and reason behind the answer please.

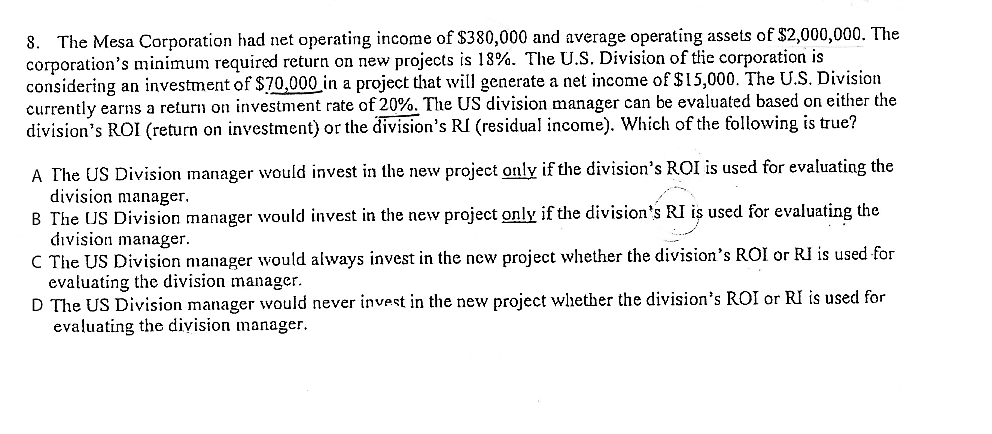

The Mesa Corporation had net operating income of $380,000 and average operating assets of $2,000,000. The corporation's minimum required return on new projects is 18%. The U.S. Division of the corporation is considering an investment of $70,000 .in a project that will generate a net income of $15,000. The U.S. Division currently earns a return on investment rate of 20%. The US division manager can be evaluated based on either the division's ROI (return on investment) or the division's RJ (residual income). Which of the following is true? A The US Division manager would invest in the new project only if the division's ROI is used for evaluating the division manager. B. The US Division manager would invest in the new project only if the division's RI is used for evaluating the division manager. C. The US Division manager would always invest in the new project whether the division's ROI or RI is used for evaluating the division manager. D. The US Division manager would never invest in the new project whether the division's ROI or RI is used for evaluating the division manager

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts