Question: show steps using financial calculator inputs when necessary please 27. You plan to make a series of deposits in an interest-bearing account. You will deposit

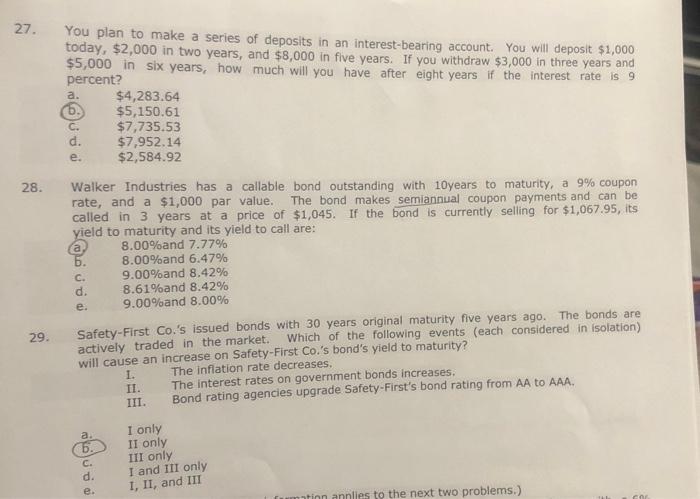

27. You plan to make a series of deposits in an interest-bearing account. You will deposit $1,000 today, $2,000 in two years, and $8,000 in five years. If you withdraw $3,000 in three years and $5,000 in six years, how much will you have after eight years if the interest rate is 9 percent? $4,283.64 6. $5,150.61 $7,735.53 d. $7,952.14 $2,584.92 a. C. e. 28. Walker Industries has a callable bond outstanding with 10years to maturity, a 9% coupon rate, and a $1,000 par value. The bond makes semiannual coupon payments and can be called in 3 years at a price of $1,045. If the bond is currently selling for $1,067.95, its yield to maturity and its yield to call are: a 8.00%and 7.77% b. 8.00%and 6.47% C. 9.00%and 8.42% d. 8.61%and 8.42% e. 9.00%and 8.00% 29. Safety-First Co.'s issued bonds with 30 years original maturity five years ago. The bonds are actively traded in the market. Which of the following events (each considered in isolation) will cause an increase on Safety-First Co.'s bond's yield to maturity? 1. The inflation rate decreases. II. The interest rates on government bonds increases. III. Bond rating agencies upgrade Safety-First's bond rating from AA to AAA. a 6. C. d. I only II only III only I and III only I, II, and III e. natinn annlies to the next two problems.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts