Question: show steps when solving Saved Help Save&Exit Submit Exercise 11-17 Cost of a natural resource; depletion and depreciation; Chapters 10 and 11 [LO11-2, 11-3] Check

![11-3] Check my work Jackpot Mining Company operates a copper mine in](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ffb1624d319_12166ffb16181d42.jpg)

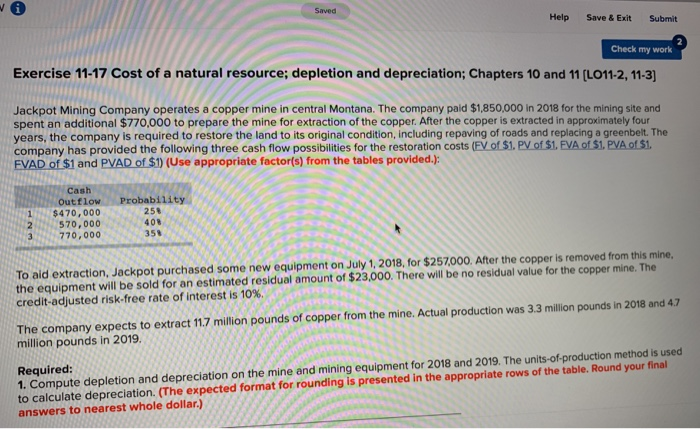

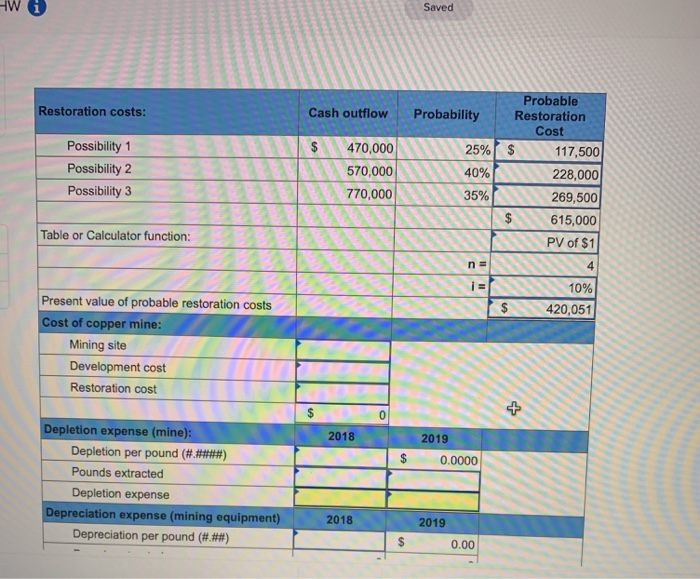

Saved Help Save&Exit Submit Exercise 11-17 Cost of a natural resource; depletion and depreciation; Chapters 10 and 11 [LO11-2, 11-3] Check my work Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,850,000 in 2018 for the mining site and spent an additional $770,000 to prepare the mine for extraction of the copper. After the copper is extracted in approximately four years, the company is required to restore the land to its original condition, including repaving of roads and replacing a greenbelt. The cormpany has provided the following three cash flow possibilities for the restoration costs Eyot$1. PV of$1. EVAoSI.BA0S. EVAD of $1 and PVAD of $) (Use appropriate factorfs) from the tables provided.): Cash outflow Probability 1$470,000 2 570,000 3770,000 258 408 358 To aid extraction, Jackpot purchased some new equipment on July 1, 2018, for $257,000. After the copper is removed from this mine, the equipment will be sold for an estimated residual amount of $23,000. There will be no residual value for the copper mine. The credit-adjusted risk-free rate of interest is 10%. The company expects to extract 11.7 million pounds of copper from the mine. Actual production was 3.3 million pounds in 2018 and 47 million pounds in 2019. Required: 1. Compute depletion and depreciation on the mine and mining equipment for 2018 and 2019. The units-of-production method is used to calculate depreciation. (The expected format for rounding is presented in the appropriate rows of the table. Round your final answers to nearest whole dollar.) Saved Probable Cash outflow Probability Restoration Restoration costs Cost $ 470,000 570,000 770,000 117,500 228,000 269,500 $615,000 PV of $1 4 10% 420,051 2596 40% 35% $ Possibility1 Possibility 2 Possibility3 Table or Calculator function: na Present value of probable restoration costs ost of copper mine: Mining site Development cost Restoration cost Depletion expense (mine) 2018 2019 $0.0000 Pounds extracted Depletion expense 2018 Depreciation expense (mining equipment) 2019 Depreciation per pound (###) 0.00 PV of $1 4 10% 420,051 Table or Calculator function: n= Present value of probable restoration costs ost of copper mine: Mining site Development cost Restoration cost Depletion expense (mine) 2018 2019 $0.0000 Pounds extracted Depletion expense preciation expense (mining equipment) 2018 201 Depreciation per pound (###) Pounds extracted Depreciation expense 0.00 0 Saved Help Save&Exit Submit Exercise 11-17 Cost of a natural resource; depletion and depreciation; Chapters 10 and 11 [LO11-2, 11-3] Check my work Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,850,000 in 2018 for the mining site and spent an additional $770,000 to prepare the mine for extraction of the copper. After the copper is extracted in approximately four years, the company is required to restore the land to its original condition, including repaving of roads and replacing a greenbelt. The cormpany has provided the following three cash flow possibilities for the restoration costs Eyot$1. PV of$1. EVAoSI.BA0S. EVAD of $1 and PVAD of $) (Use appropriate factorfs) from the tables provided.): Cash outflow Probability 1$470,000 2 570,000 3770,000 258 408 358 To aid extraction, Jackpot purchased some new equipment on July 1, 2018, for $257,000. After the copper is removed from this mine, the equipment will be sold for an estimated residual amount of $23,000. There will be no residual value for the copper mine. The credit-adjusted risk-free rate of interest is 10%. The company expects to extract 11.7 million pounds of copper from the mine. Actual production was 3.3 million pounds in 2018 and 47 million pounds in 2019. Required: 1. Compute depletion and depreciation on the mine and mining equipment for 2018 and 2019. The units-of-production method is used to calculate depreciation. (The expected format for rounding is presented in the appropriate rows of the table. Round your final answers to nearest whole dollar.) Saved Probable Cash outflow Probability Restoration Restoration costs Cost $ 470,000 570,000 770,000 117,500 228,000 269,500 $615,000 PV of $1 4 10% 420,051 2596 40% 35% $ Possibility1 Possibility 2 Possibility3 Table or Calculator function: na Present value of probable restoration costs ost of copper mine: Mining site Development cost Restoration cost Depletion expense (mine) 2018 2019 $0.0000 Pounds extracted Depletion expense 2018 Depreciation expense (mining equipment) 2019 Depreciation per pound (###) 0.00 PV of $1 4 10% 420,051 Table or Calculator function: n= Present value of probable restoration costs ost of copper mine: Mining site Development cost Restoration cost Depletion expense (mine) 2018 2019 $0.0000 Pounds extracted Depletion expense preciation expense (mining equipment) 2018 201 Depreciation per pound (###) Pounds extracted Depreciation expense 0.00 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts