Question: SHOW SUPPORTING CALCULATIONS ON PROBLEMS TO EARN MAXIMUM POINTS! Question # 2 Accounts Receivable and Bad Debt problems ( 4 parts, 8 total points )

SHOW SUPPORTING CALCULATIONS ON PROBLEMS TO EARN MAXIMUM POINTS!

Question # Accounts Receivable and Bad Debt problems parts, total points

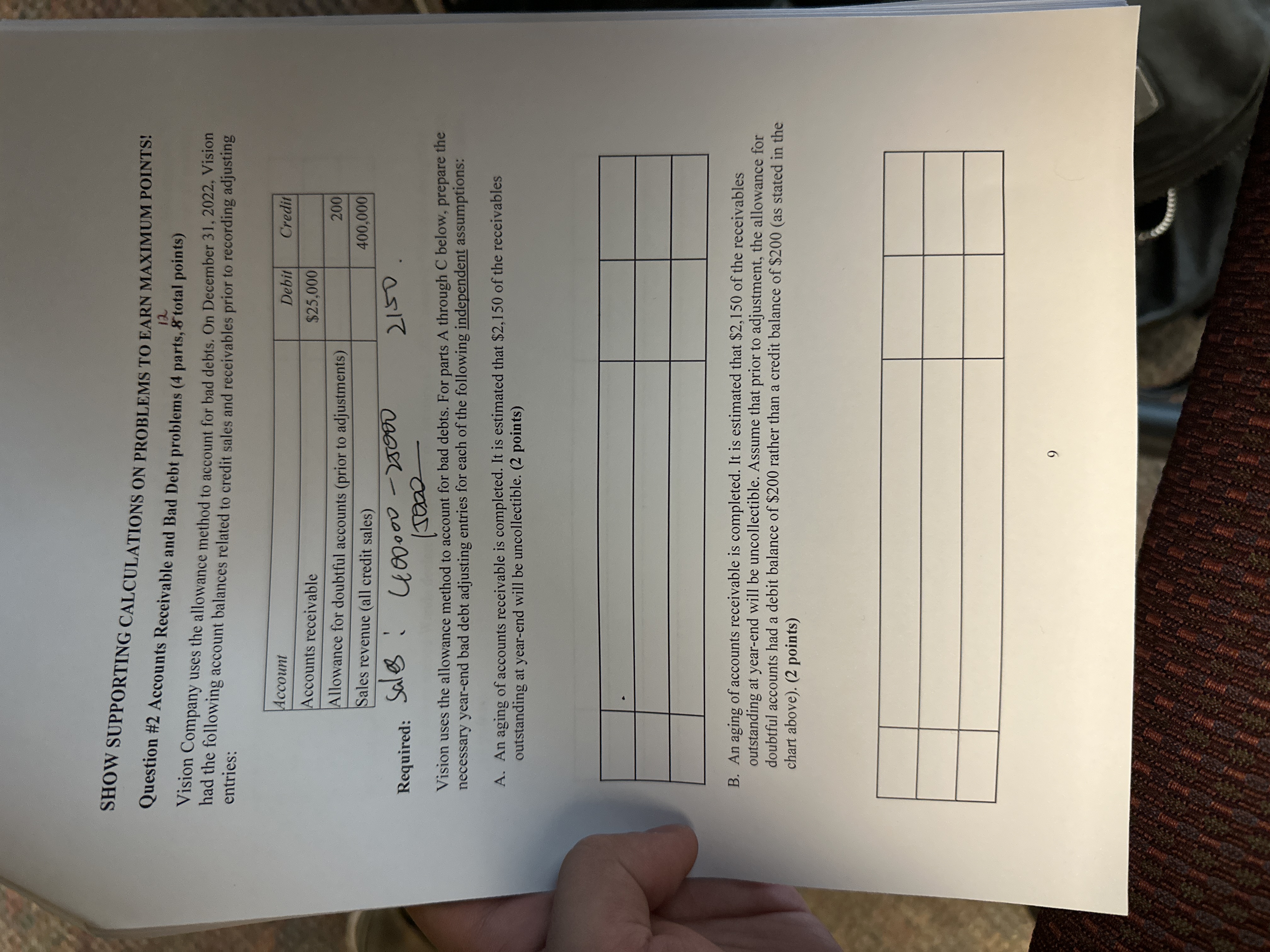

Vision Company uses the allowance method to account for bad debts. On December Vision

had the following account balances related to credit sales and receivables prior to recording adjusting

entries:

Vision uses the allowance method to account for bad debts. For parts A through below, prepare the

necessary yearend bad debt adjusting entries for each of the following independent assumptions:

A An aging of accounts receivable is completed. It is estimated that $ of the receivables

outstanding at yearend will be uncollectible. points

B An aging of accounts receivable is completed. It is estimated that $ of the receivables

outstanding at yearend will be uncollectible. Assume that prior to adjustment, the allowance for

doubtful accounts had a debit balance of $ rather than a credit balance of $as stated in the

chart above points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock