Question: show the answer by using financial calculator 16. It will cost $10,000 to acqure an Jequipment for your factory that is expected to produce cash

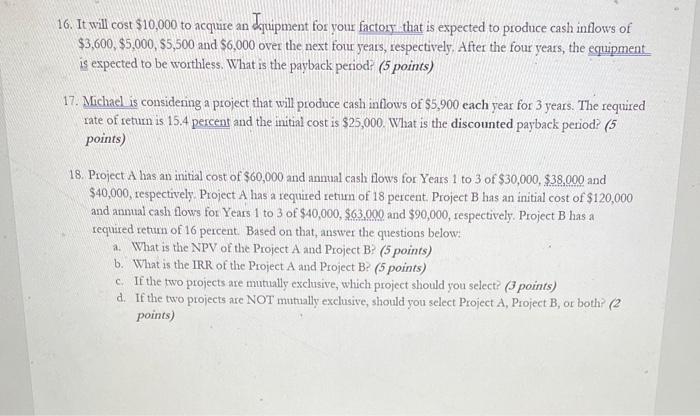

16. It will cost $10,000 to acqure an Jequipment for your factory that is expected to produce cash inflows of $3,600, $5,000, $5,500 and $6,000 over the next four years, respectively. After the four years, the equipment is expected to be worthless. What is the payback period (5 points) 17. Michael is considering a project that will produce cash inflows of $5,900 each year for 3 years. The required rate of return is 15.4 percent and the initial cost is $25,000. What is the discounted payback period (5 points) 18. Project A has an initial cost of $60,000 and annual cash flows for Years 1 to 3 of $30,000, $38.000 and $40,000, respectively. Project A has a required return of 18 percent. Project B has an initial cost of $120,000 and annual cash flows for Years 1 to 3 of $40,000, $63.000 and $90,000, respectively. Project B has a required return of 16 percent. Based on that, answer the questions below: a. What is the NPV of the Project A and Project B (5 points) b. What is the IRR of the Project A and Project B: (5 points) c. If the two projects are mutually exclusive, which project should you selectpoints) d. If the two projects are NOT mutually exclusive, should you select Project A, Project B, or both (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts