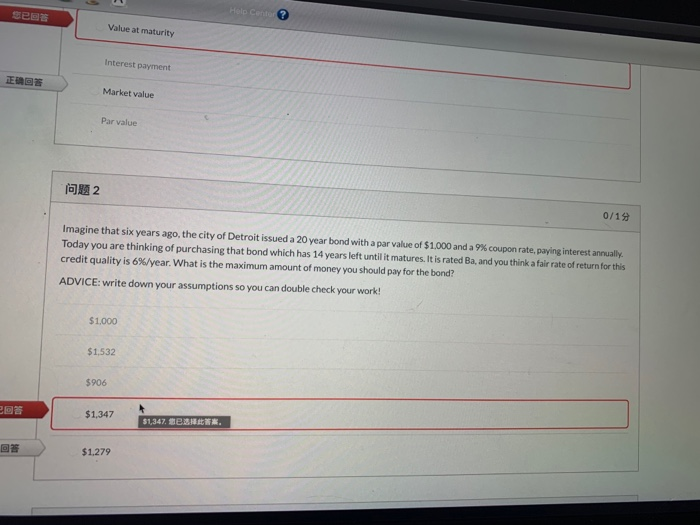

Question: show the process please. thanks you SPEE Hele ce? Value at maturity Interest payment ED Market value Par value 1922 0/19 Imagine that six years

SPEE Hele ce? Value at maturity Interest payment ED Market value Par value 1922 0/19 Imagine that six years ago, the city of Detroit issued a 20 year bond with a par value of $1,000 and a 9% coupon rate, paying interest annually. Today you are thinking of purchasing that bond which has 14 years left until it matures. It is rated Ba, and you think a fair rate of return for this credit quality is 6%/year. What is the maximum amount of money you should pay for the bond? ADVICE: write down your assumptions so you can double check your work! $1,000 $1,532 $906 $1,347 $1,347. Bes. 2 $1.279

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts