Question: Show the solution and the answer. Thanks rate if U.S. interest is 9%, Japanese interest is 7%, and the spot rate is 30.003700/1? Use a

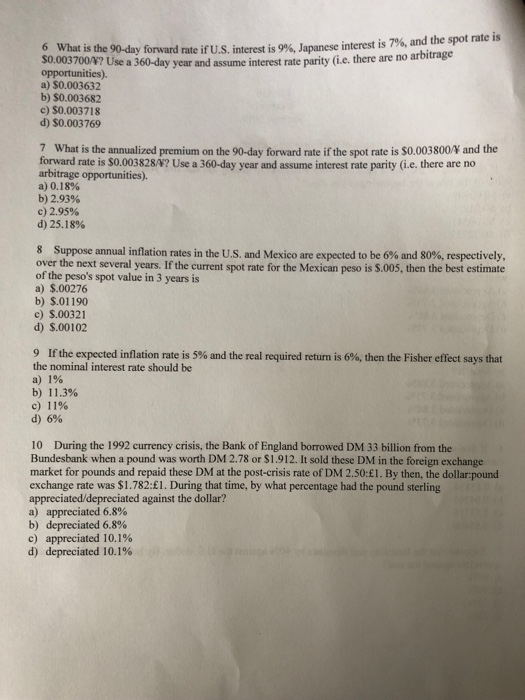

rate if U.S. interest is 9%, Japanese interest is 7%, and the spot rate is 30.003700/1? Use a 360-day year and assume interest rate parity (ie, there are no arbitrage opportunities). a) S0.003632 b) SO.003682 c) 50.003718 d) S0.003769 7 What is the annualized premium on the 90-day forward rate if the spot rate is $0.003800 and the forward rate is $0.003828/17 Use a 360-day year and assume interest rate parity (ie, there are no arbitrage opportunities). a) 0.18% b) 2.93% c) 2.95% d) 25.18% 8 Suppose annual inflation rates in the U.S. and Mexico are expected to be 6% and 80%, respectively, over the next several years. If the current spot rate for the Mexican peso is 5.005, then the best estimate of the peso's spot value in 3 years is a) $.00276 b) $.01190 c) 3.00321 d) $.00102 9 If the expected inflation rate is 5% and the real required return is 6%, then the Fisher effect says that the nominal interest rate should be a) 1% b) 11.3% c) 11% d) 6% 10 During the 1992 currency crisis, the Bank of England borrowed DM 33 billion from the Bundesbank when a pound was worth DM 2.78 or $1.912. It sold these DM in the foreign exchange market for pounds and repaid these DM at the post-crisis rate of DM 2.50:1. By then, the dollar pound exchange rate was $1.782:1. During that time, by what percentage had the pound sterling appreciated/depreciated against the dollar? a) appreciated 6.8% b) depreciated 6.8% c) appreciated 10.1% d) depreciated 10.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts