Question: Show the solution: (D) Problem 28-7 (Page 826): Vanity Company: At the beginning of current year, Vanity Company purchased a mineral mine for P26, 400,000

Show the solution:

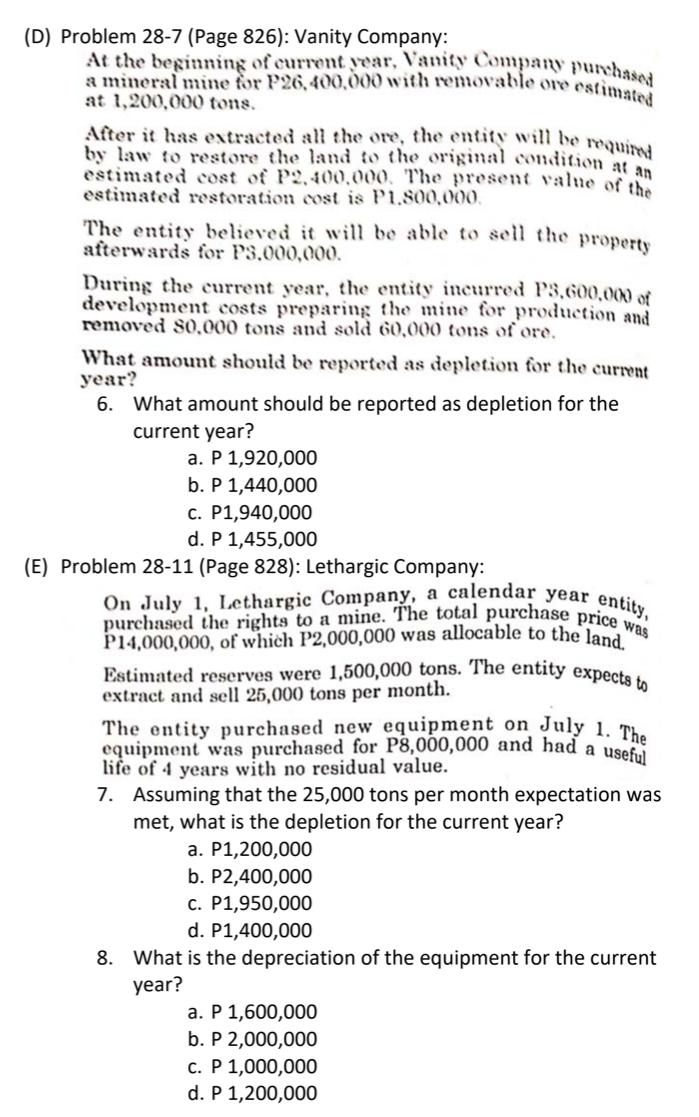

(D) Problem 28-7 (Page 826): Vanity Company: At the beginning of current year, Vanity Company purchased a mineral mine for P26, 400,000 with removable ore estimated at 1,200,000 tons. After it has extracted all the ore, the entity will be required by law to restore the land to the original condition at an estimated cost of P2. 400.000. The present value of the estimated restoration cost is P1.800,000. The entity believed it will be able to sell the property afterwards for P3.000,000. During the current year, the entity incurred P3.600,000 of development costs preparing the mine for production and removed 80.000 tons and sold 60,000 tons of ore. What amount should be reported as depletion for the current year? 6. What amount should be reported as depletion for the current year? a. P 1,920,000 b. P 1,440,000 c. P1,940,000 d. P 1,455,000 (E) Problem 28-11 (Page 828): Lethargic Company: On July 1, Lethargic Company, a calendar year entity purchased the rights to a mine. The total purchase price was P14,000,000, of which P2,000,000 was allocable to the land." Estimated reserves were 1,500,000 tons. The entity expects to extract and sell 25,000 tons per month. The entity purchased new equipment on July 1. The equipment was purchased for P8,000,000 and had a useful life of 4 years with no residual value. 7. Assuming that the 25,000 tons per month expectation was met, what is the depletion for the current year? a. P1,200,000 b. P2,400,000 c. P1,950,000 d. P1,400,000 8. What is the depreciation of the equipment for the current year? a. P 1,600,000 b. P 2,000,000 c. P 1,000,000 d. P 1,200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts