Question: show the solution PROBLEM 5. On January 2, 2012, Power Company acquired 90% of the outstanding shares of Solar Inc. at book value. During 2012

show the solution

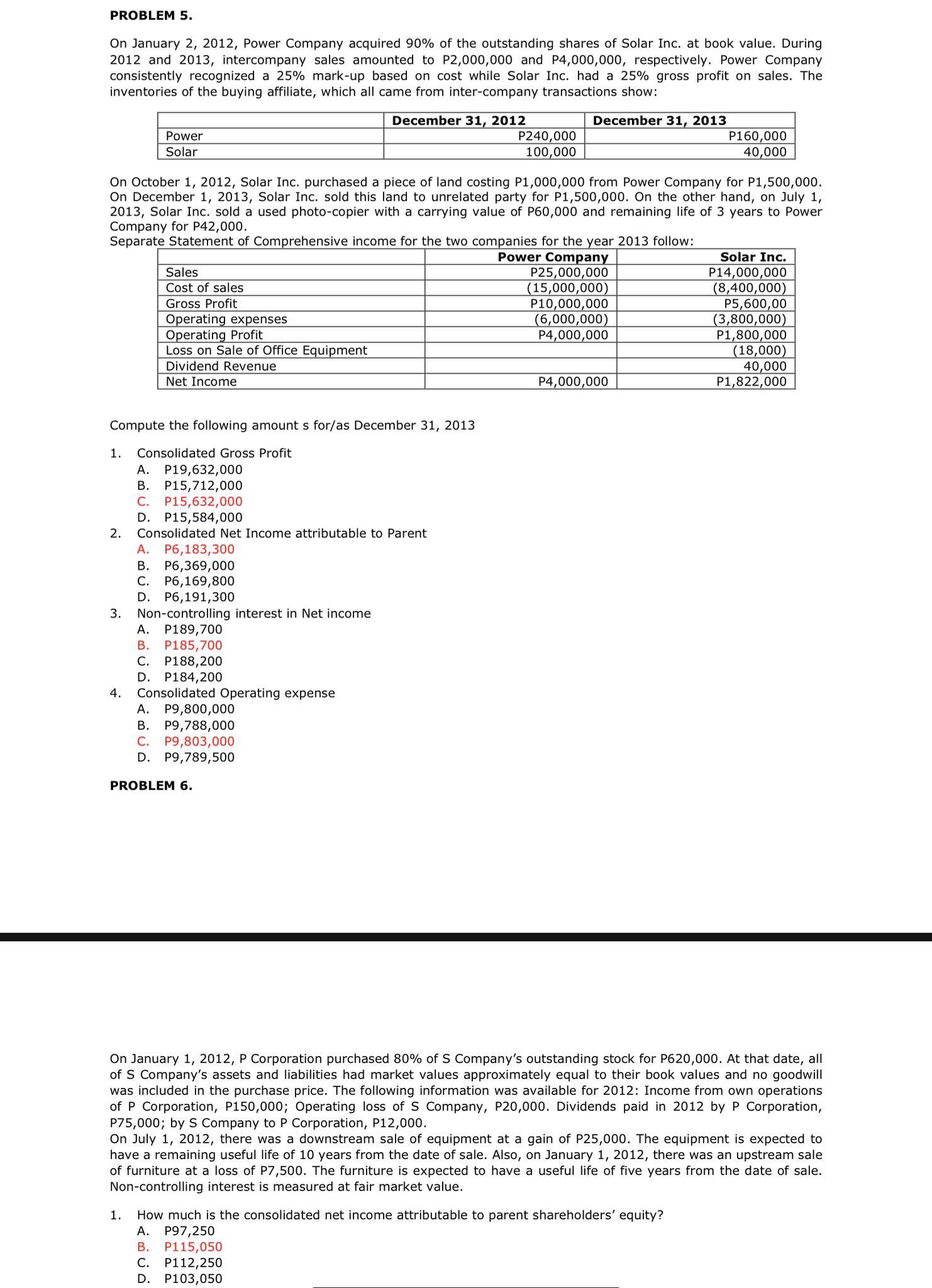

PROBLEM 5. On January 2, 2012, Power Company acquired 90% of the outstanding shares of Solar Inc. at book value. During 2012 and 2013, intercompany sales amounted to P2,000,000 and P4,000,000, respectively. Power Company consistently recognized a 25% mark-up based on cost while Solar Inc. had a 25% gross profit on sales. The inventories of the buying affiliate, which all came from inter-company transactions show: _ December 31 2012 December 31 2013 P240 000 P160 000 100 000 40 000 On October 1, 2012, Solar Inc. purchased a piece of land costing P1,000,000 from Power Company for P1,500,000. On December 1, 2013, Solar Inc. sold this land to unrelated party for P1,500,000. On the other hand, on July 1, 2013, Solar Inc. sold a used photo-copier with a carrying value of P60,000 and remaining life of 3 years to Power Company for P42,0DD. Separate Statement of Corn - rehensive income for the two com -anies for the ear 2013 follow: Power Com - an P25 000 000 P14 000 000 Cost of sales 15 000,000 8 400 000 Gross Profit P10 000 000 P5 600 00 6 000 000 3 800 000 P4 000 000 P1 800 000 18 000 40 000 um P4 000 000 P1 822 000 Compute the following amount s for/as December 31, 2013 1. Consolidated Gross Prot A. P19,632,000 B. P15,712,000 C. P15,632,000 D. P15,584,000 2. Consolidated Net Income attributable to Parent A. P6,183,300 B. P6,369,000 C. P6,169,BDO D. P6,191,300 3. Non-controlling interest in Net income A. P189,700 B. P185,700 C. P188,200 D. P184,200 4. Consolidated Operating expense A. P9,800,000 B. P9388300 C. P9,803,000 0. P9389500 PROBLEM 6. On January 1, 2012, P Corporation purchased 80% of S Company's outstanding stock for P620,000. At that date, all of S Company's assets and liabilities had market values approximately equal to their book values and no goodwill was included in the purchase price. The following information was available for 2012: Income from own operations of P Corporation, P150,000, Operating loss of 5 Company, P20,000. Dividends paid in 2012 by P Corporation, P75,000; by 5 Company to P Corporation, P12,000. On July 1, 2012, there was a downstream sale of equipment at a gain of P25,000. The equipment is expected to have a remaining useful life of 10 years from the date of sale. Also, on January 1, 2012, there was an upstream sale of furniture at a loss of P7,500. The furniture is expected to have a useful life of ve years from the date of sale. Noncontrolling interest is measured at fair market value. 1. How much is the consolidated net income attributable to parent shareholders' equity? P97,250 P115,050 P112,250 P103,050 POP\

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts