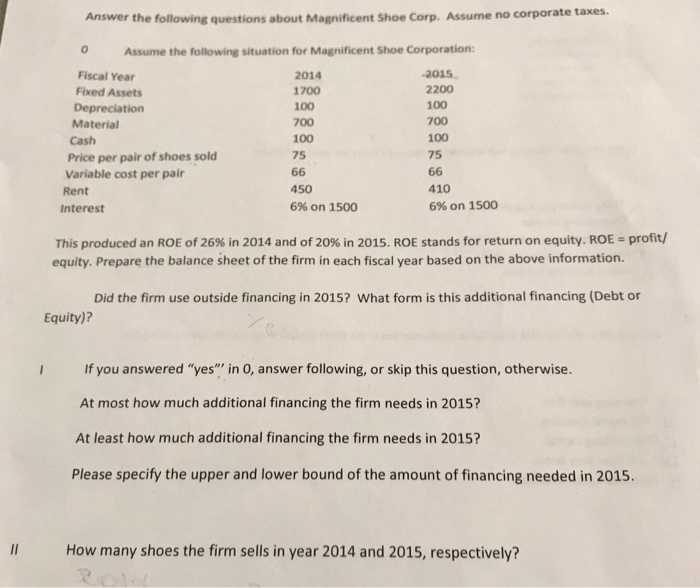

Question: Show the whoe work for question 1 and 2 Answer the following questions about Magnificent Shoe Corp. Assume no corporate taxes. Assume the following situation

Answer the following questions about Magnificent Shoe Corp. Assume no corporate taxes. Assume the following situation for Magnificent Shoe Corporation 2015 2200 100 700 100 75 Fiscal Year 2014 1700 100 700 100 75 Fixed Assets Depreciation Material Cash Price per pair of shoes sold Variable cost per pair 450 6% on 1500 410 6% on 1500 Rent Interest This produced an ROE of 26% in 2014 and of 20% in 2015. ROE stands for return on equity. ROE-profit/ equity. Prepare the balance sheet of the firm in each fiscal year based on the above information. Did the firm use outside financing in 2015? What form is this additional financing (Debt or Equity)? If you answered "yes"" in O, answer following, or skip this question, otherwise. At most how much additional financing the firm needs in 2015? At least how much additional financing the firm needs in 2015? I Please specify the upper and lower bound of the amount of financing needed in 2015. II How many shoes the firm sells in year 2014 and 2015, respectively? Answer the following questions about Magnificent Shoe Corp. Assume no corporate taxes. Assume the following situation for Magnificent Shoe Corporation 2015 2200 100 700 100 75 Fiscal Year 2014 1700 100 700 100 75 Fixed Assets Depreciation Material Cash Price per pair of shoes sold Variable cost per pair 450 6% on 1500 410 6% on 1500 Rent Interest This produced an ROE of 26% in 2014 and of 20% in 2015. ROE stands for return on equity. ROE-profit/ equity. Prepare the balance sheet of the firm in each fiscal year based on the above information. Did the firm use outside financing in 2015? What form is this additional financing (Debt or Equity)? If you answered "yes"" in O, answer following, or skip this question, otherwise. At most how much additional financing the firm needs in 2015? At least how much additional financing the firm needs in 2015? I Please specify the upper and lower bound of the amount of financing needed in 2015. II How many shoes the firm sells in year 2014 and 2015, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts