Question: show the work please i hope the is clear fast please 5 Dhe NI H haradana 2.0 pod magn 16.00 s W Cute treat gs

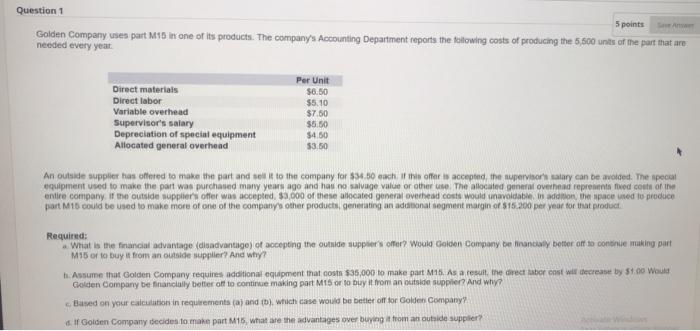

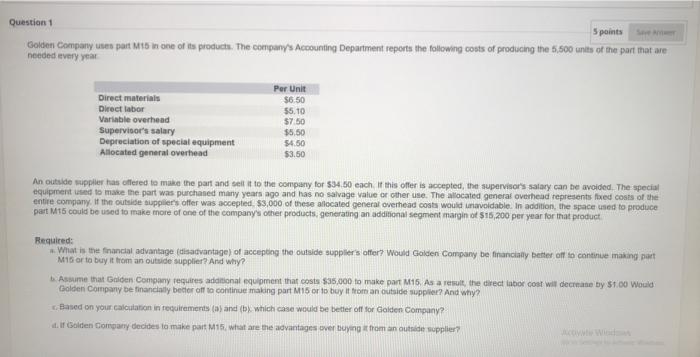

5 Dhe NI H haradana 2.0 pod magn 16.00 s W Cute treat gs MIS : - at- 3510 m. Variable wy Derec A 44 EDOX -AT-WAX BTV A Question 1 Golden Company uses part M15 in one of its products. The company's Accounting Department reports the following costs of producing the 5.500 units of the part that are 5 points needed every year Direct materials Direct labor Variable overhead Supervisor's salary Depreciation of special equipment Allocated general overhead Per Unit $6.50 $5.10 $7.50 $5.50 $4.50 53.50 An outside supplier has offered to make the part and sell it to the company for $34.50 each of the offers accepted the supervisor's salary can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or others. The allocated general overhead represented cost of the entire company. If the outside suppliers offer was accepted. $1,000 of these allocated general overhead costs would unavoidable, in addition the space wed to produce part M 15 could be used to make more of one of the company other products, generating an additionat segment margin of $15.200 per year for that product Required: What is the financial advantage (disadvantage of accepting the outside suppliers offer? Would Golden Company Hinancy better off to continue making part M15 or to buy it from an outside supplier? And why? b. Assume that Golden Company requires additional equipment that costs $35,000 to make part M16. As a result, the great stor ons wil decrease by $1.00 Would Golden Company be financially better off to continue making part Mis or to buy it from an outside supplier? And why Based on your calculation in requirements (a) and (b), which case would be better off for Golden Company of Golden Company decides to make part M15. What are the advantages over buying it from an outside supplier Question 1 5 points Golden Company was part M15 in one of its products. The company's Accounting Department reports the following costs of producing the 5.500 units of the part that are needed every year Direct materiais Direct labor Variable overhead Supervisor's salary Depreciation of special equipment Allocated general overhead Per Unit $6.50 55.10 $7.50 $5.50 $4.50 $3.50 An outside supplier has offered to make the part and sell it to the company for $34.50 each. If this offer is accepted, the supervisor's salary can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. It the outside suppliers offer was accepted $3,000 of these allocated general overhead costs would unavoidable. In addition, the space used to produce part 15 could be used to make more of one of the company other products, generating an additional segment margin of 515,200 per year for that product Required: What is the financial advantage (disadvantage of acceptg the outside suppliers offer? Would Golden Company bie financially better off to continue making part M16 or to buy it from an outside supplier? And why? Assume that Gaiden Company requires additional equipment that costs $35,000 to make part M15. As a result, the direct labor cost will decane by $1.00 Would Golden Company be financially better off to continue making part M15 or to buy it from an outside supplier? And why? Based on your calculation in requirements (1) and (by which case would be better off for Golden Company? d. Golden Company decides to make part M15. what are the advantages over buying from an outside supplier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts