Question: Show the works for D and E Activity #6: COGM/COGS and Over-Under-Applied Overhead (LO#2, #3, #4, #5) Smelly Fishery is a canning company in Fragrant

Show the works for D and E

Show the works for D and E

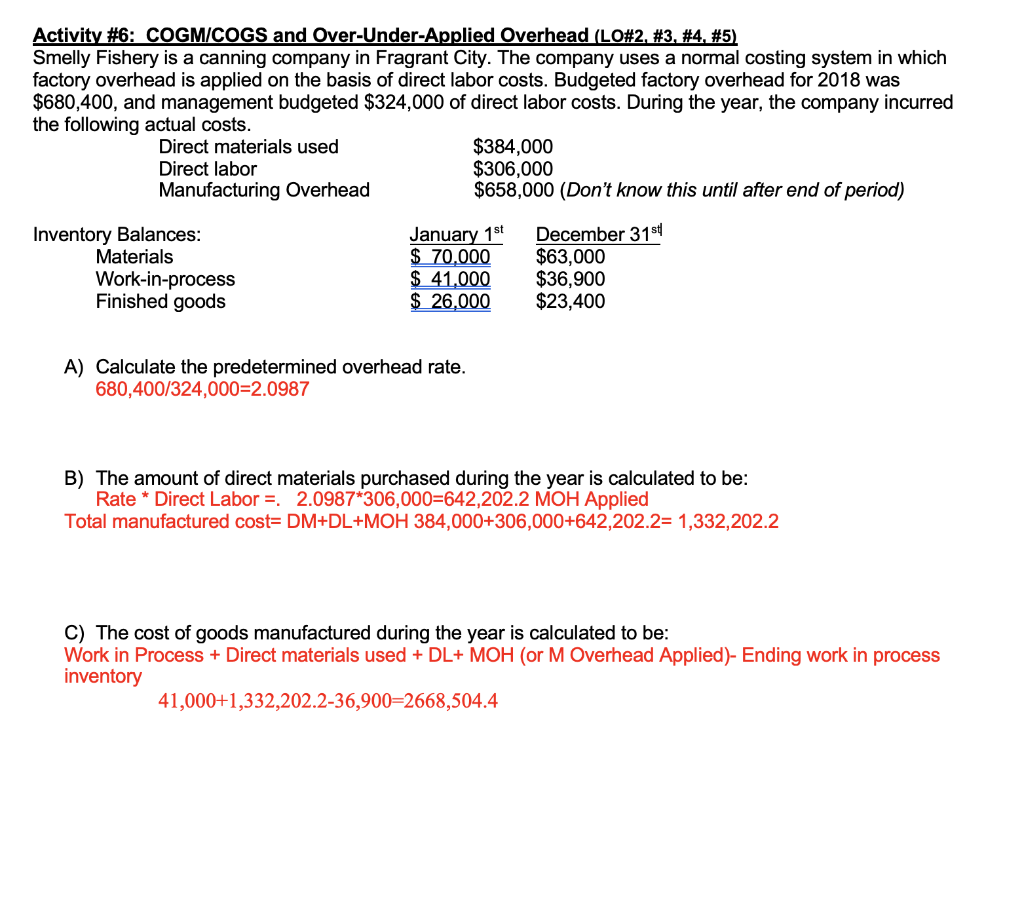

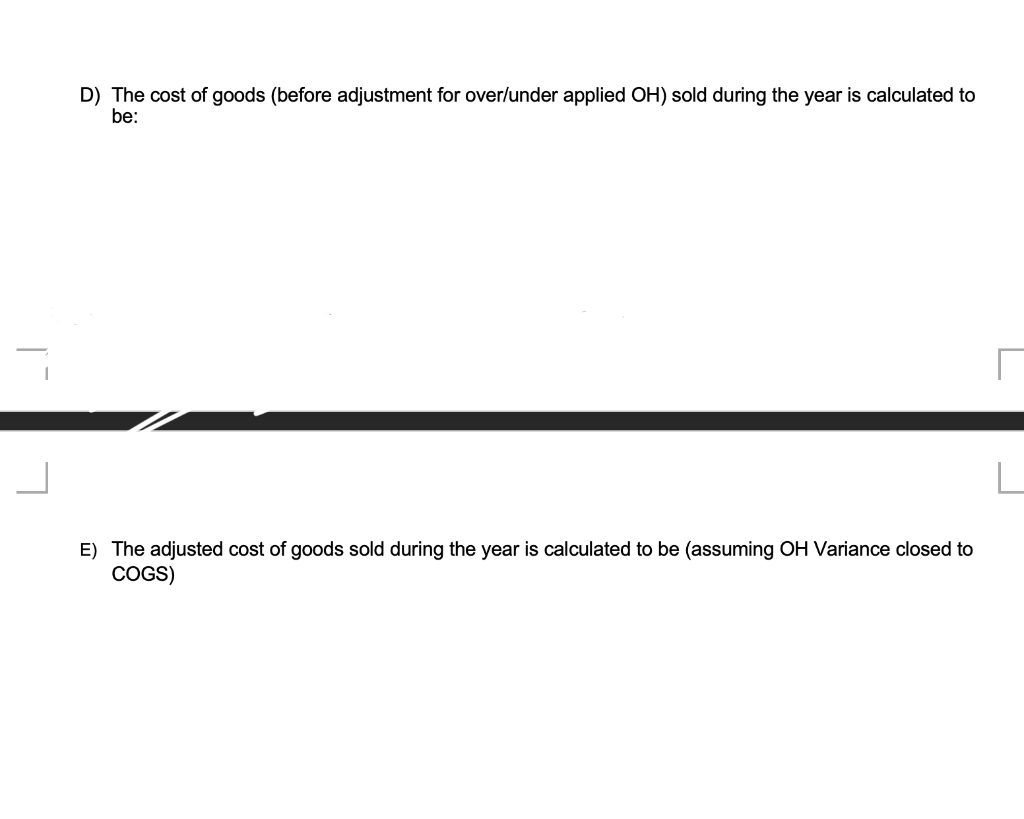

Activity #6: COGM/COGS and Over-Under-Applied Overhead (LO#2, #3, #4, #5) Smelly Fishery is a canning company in Fragrant City. The company uses a normal costing system in which factory overhead is applied on the basis of direct labor costs. Budgeted factory overhead for 2018 was $680,400, and management budgeted $324,000 of direct labor costs. During the year, the company incurred the following actual costs. Direct materials used $384,000 Direct labor $306,000 Manufacturing Overhead $658,000 (Don't know this until after end of period) Inventory Balances: Materials Work-in-process Finished goods January 1st $ 70.000 $ 41,000 $ 26,000 December 315 $63,000 $36,900 $23,400 A) Calculate the predetermined overhead rate. 680,400/324,000=2.0987 B) The amount of direct materials purchased during the year is calculated to be: Rate * Direct Labor = 2.0987*306,000=642,202.2 MOH Applied Total manufactured cost=DM+DL+MOH 384,000+306,000+642,202.2= 1,332,202.2 C) The cost of goods manufactured during the year is calculated to be: Work in Process + Direct materials used + DL+ MOH (or M Overhead Applied)- Ending work in process inventory 41,000+1,332,202.2-36,900=2668,504.4 D) The cost of goods (before adjustment for over/under applied OH) sold during the year is calculated to be: E) The adjusted cost of goods sold during the year is calculated to be (assuming OH Variance closed to COGS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts