Question: Show Timer Question Completion Status: Jan. 27 Marlowe Company is a wholesaler who uses the LIFO cost flow assumption to value its inventory and determine

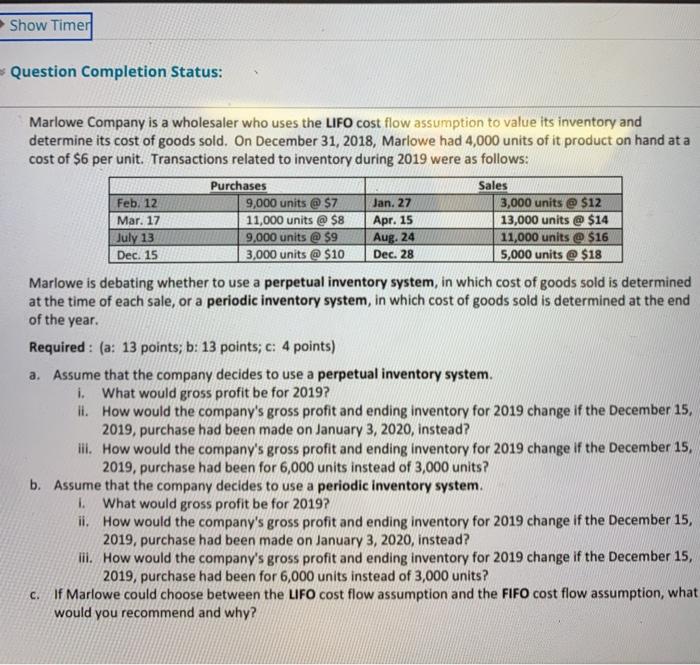

Show Timer Question Completion Status: Jan. 27 Marlowe Company is a wholesaler who uses the LIFO cost flow assumption to value its inventory and determine its cost of goods sold. On December 31, 2018, Marlowe had 4,000 units of it product on hand at a cost of $6 per unit. Transactions related to inventory during 2019 were as follows: Purchases Sales Feb. 12 9,000 units @ $7 3,000 units @ $12 Mar. 17 11,000 units @ $8 Apr. 15 13,000 units @ $14 July 13 9,000 units @ $9 Aug. 24 11,000 units @ $16 Dec. 15 3,000 units @ $10 Dec. 28 5,000 units @ $18 Marlowe is debating whether to use a perpetual inventory system, in which cost of goods sold is determined at the time of each sale, or a periodic inventory system, in which cost of goods sold is determined at the end of the year. Required: (a: 13 points; b: 13 points;c: 4 points) a. Assume that the company decides to use a perpetual inventory system. i. What would gross profit be for 2019? it. How would the company's gross profit and ending inventory for 2019 change if the December 15, 2019. purchase had been made on January 3, 2020, instead? ill. How would the company's gross profit and ending inventory for 2019 change if the December 15, 2019, purchase had been for 6,000 units instead of 3,000 units? b. Assume that the company decides to use a periodic inventory system. 1. What would gross profit be for 2019? ii. How would the company's gross profit and ending inventory for 2019 change if the December 15, 2019, purchase had been made on January 3, 2020, instead? ill. How would the company's gross profit and ending inventory for 2019 change if the December 15, 2019, purchase had been for 6,000 units instead of 3,000 units? c. If Marlowe could choose between the LIFO cost flow assumption and the FIFO cost flow assumption, what would you recommend and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts