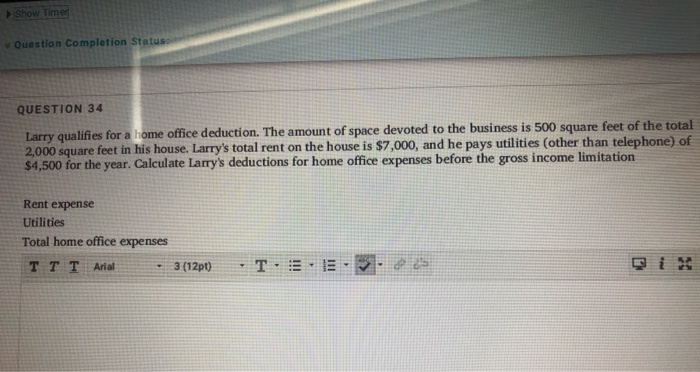

Question: Show Timer Question Completion Statuss QUESTION 34 Larry qualifies for a home office deduction. The amount of space devoted to the business is 500 square

Show Timer Question Completion Statuss QUESTION 34 Larry qualifies for a home office deduction. The amount of space devoted to the business is 500 square feet of the total 2,000 square feet in his house. Larry's total rent on the house is $7,000, and he pays utilities (other than telephone) of $4,500 for the year. Calculate Larry's deductions for home office expenses before the gross income limitation Rent expense Utilities Total home office expenses TT T Arial 3 (120) T.EE 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts