Question: Show using Excel please 5. Consider two mutual funds, A and B, that invest in identical securities. The funds are expected to generate 6.8% return

Show using Excel please

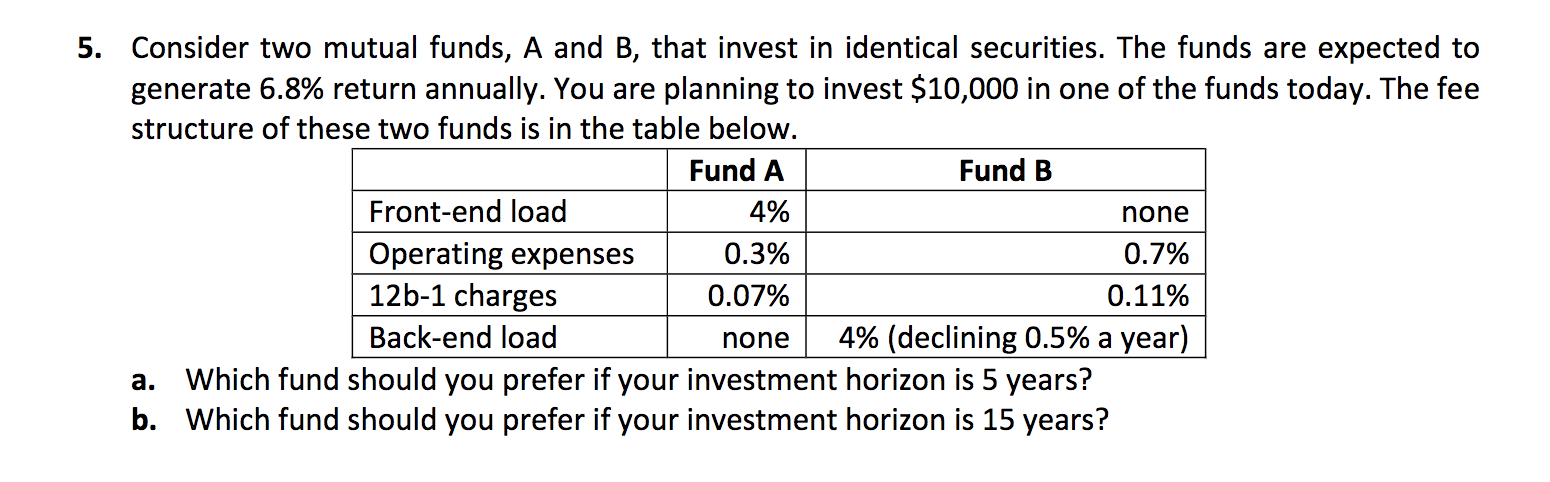

5. Consider two mutual funds, A and B, that invest in identical securities. The funds are expected to generate 6.8% return annually. You are planning to invest $10,000 in one of the funds today. The fee structure of these two funds is in the table below. Fund A Fund B Front-end load 4% none Operating expenses 0.3% 0.7% 12b-1 charges 0.07% 0.11% Back-end load none 4% (declining 0.5% a year) a. Which fund should you prefer if your investment horizon is 5 years? b. Which fund should you prefer if your investment horizon is 15 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts