Question: show with steps too pls 16) The Jackson Co. is currently in the business of making kitchen cabinets. It has $400,000 in outstanding bonds with

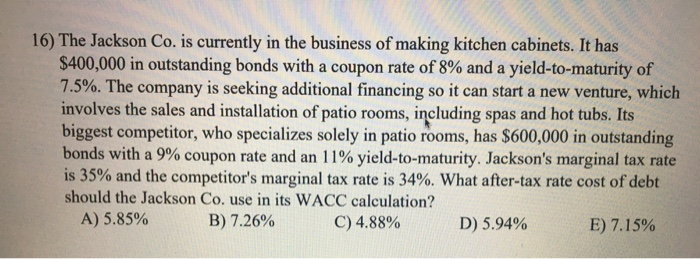

16) The Jackson Co. is currently in the business of making kitchen cabinets. It has $400,000 in outstanding bonds with a coupon rate of 8% and a yield-to-maturity of 7.5%. The company is seeking additional financing so it can start a new venture, which involves the sales and installation of patio rooms, including spas and hot tubs. Its biggest competitor, who specializes solely in patio rooms, has $600,000 in outstanding! bonds with a 9% coupon rate and an 11% yield-to-maturity. Jackson's marginal tax rate is 35% and the competitor's marginal tax rate is 34%. What after-tax rate cost of debt should the Jackson Co. use in its WACC calculation? A) 5.85% B) 7.26% C) 4.88% D) 5.94% E) 7.15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts