Question: show work and explain how you got it so i can understand how to do it. if unable to submit answer pls try again 2.

show work and explain how you got it so i can understand how to do it. if unable to submit answer pls try again

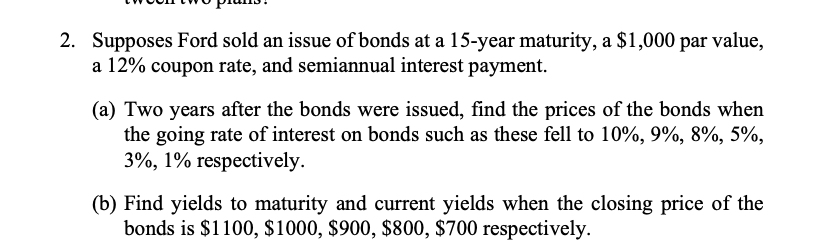

2. Supposes Ford sold an issue of bonds at a 15-year maturity, a $1,000 par value, a 12% coupon rate, and semiannual interest payment. (a) Two years after the bonds were issued, find the prices of the bonds when the going rate of interest on bonds such as these fell to 10%, 9%, 8%, 5%, 3%, 1% respectively. (b) Find yields to maturity and current yields when the closing price of the bonds is $1100, $1000, $900, $800, $700 respectively. 2. Supposes Ford sold an issue of bonds at a 15-year maturity, a $1,000 par value, a 12% coupon rate, and semiannual interest payment. (a) Two years after the bonds were issued, find the prices of the bonds when the going rate of interest on bonds such as these fell to 10%, 9%, 8%, 5%, 3%, 1% respectively. (b) Find yields to maturity and current yields when the closing price of the bonds is $1100, $1000, $900, $800, $700 respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts