Question: Show work and Formula in Excel Use the model above to address the following: Your company may buy a used pick-up for $20,000. During the

Show work and Formula in Excel

Use the model above to address the following: Your company may buy a used pick-up for $20,000. During the truck's five year useful life, it is estimated the firm will save $4,000 per year after all of the costs of owning and operating the truck have been paid. The truck's salvage value is estimated to be $3,000. Assume straight line depreciation and a tax rate of 35%. Assume r of 10%. Create a model that will calculate before-tax and after-tax cash flows. Perform the same analysis on another tab of your spreadsheet using a tax rate of 39%. Be sure to include all required elements in your file with tabs for both 35 and 39 percent tax rates.

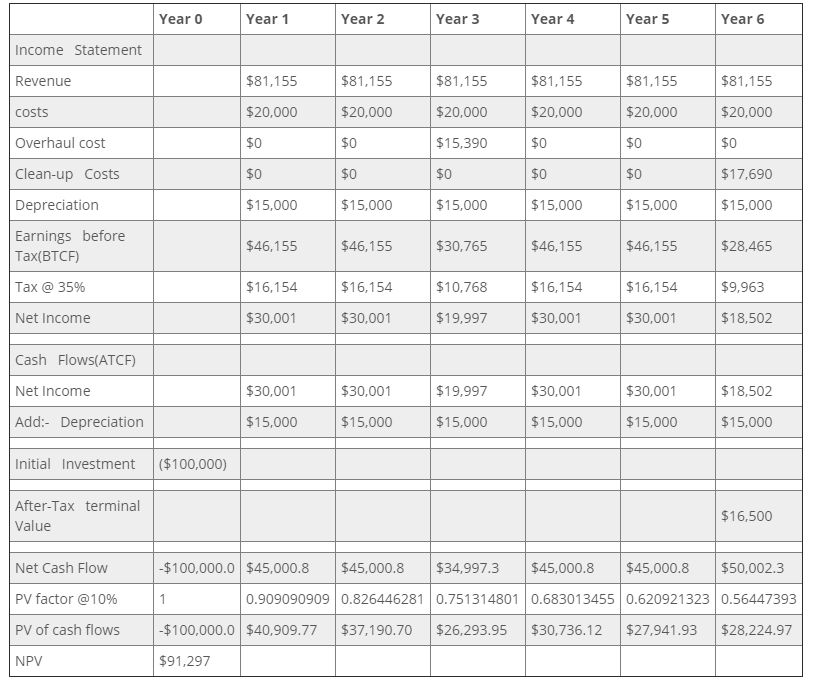

Year o Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Income Statement Revenue $81,155 $81,155 $81,155 $81,155 $81,155 $81,155 costs $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 Overhaul cost $0 $0 $15,390 $0 $0 $0 Clean-up Costs $0 $0 $0 $0 $0 $17,690 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 Depreciation Earnings before Tax(BTCF) Tax @ 35% $46,155 $46,155 $30,765 $46,155 $46,155 $28,465 $16,154 $16,154 $10,768 $16,154 $16,154 $9.963 Net Income $30,001 $30,001 $19,997 $30,001 $30,001 $18,502 Cash Flows(ATCF) Net Income $30,001 $30,001 $19.997 $30,001 $30,001 $18,502 Add:- Depreciation $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 Initial Investment ($100,000) After-Tax terminal Value $16,500 Net Cash Flow -$100,000.0 $45,000.8 $45,000.8 $34,997.3 $45,000.8 $45,000.8 $50,002.3 PV factor @10% 1 0.909090909 0.826446281 0.751314801 0.683013455 0.620921323 0.56447393 PV of cash flows $100,000.0 $40,909.77 $37,190.70 $26,293.95 $30,736.12 $27,941.93 $28,224.97 NPV $91,297Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts