Question: show work and make it clear please As a financial analyst you want to estimate the price of dividends to be $2.00 52.75 and 125

show work and make it clear please

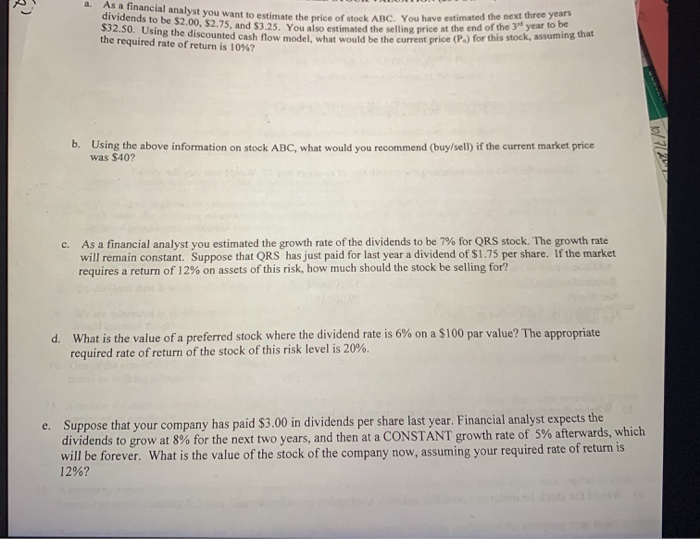

show work and make it clear please As a financial analyst you want to estimate the price of dividends to be $2.00 52.75 and 125 Yowals estimated the selling price at $32.50. Using the discounted cash flow model, ing the discounted cash flow model what would be the current price (P) for this stock, assuming the required rate of return is 10%? want to estimate the price of stock All You have estimated the next three years hated the selling price at the end of the 34 year to be b. Using the above information on stock ABC, what would you recommend (buy/sell) if the current market price was $40? 1/7/20 c. As a financial analyst you estimated the growth rate of the dividends to be 7% for QRS stock. The growth rate will remain constant. Suppose that QRS has just paid for last year a dividend of $1.75 per share. If the market requires a return of 12% on assets of this risk, how much should the stock be selling for? d. What is the value of a preferred stock where the dividend rate is 6% on a $100 par value? The appropriate required rate of return of the stock of this risk level is 20%. e. Suppose that your company has paid $3.00 in dividends per share last year. Financial analyst expects the dividends to grow at 8% for the next two years, and then at a CONSTANT growth rate of 5% afterwards, which will be forever. What is the value of the stock of the company now, assuming your required rate of return is 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts