Question: Show work and solve on paper Thanks Will rate A group of private investors borrowed $31 million to build 300 new luxury apartments near a

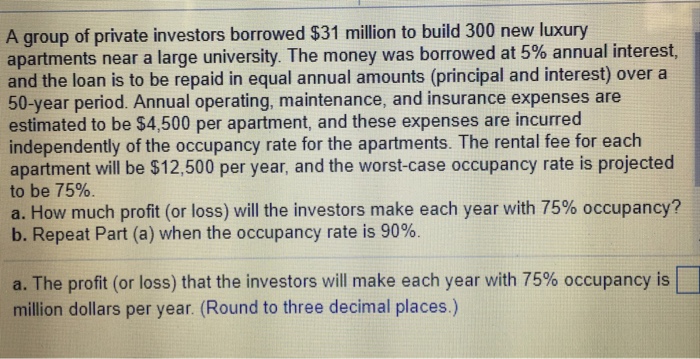

A group of private investors borrowed $31 million to build 300 new luxury apartments near a large university. The money was borrowed at 5% annual interest, and the loan is to be repaid in equal annual amounts (principal and interest) over a 50-year period. Annual operating, maintenance, and insurance expenses are estimated to be $4,500 per apartment, and these expenses are incurred independently of the occupancy rate for the apartments. The rental fee for each apartment will be $12,500 per year, and the worst-case occupancy rate is projected to be 75%. a. How much profit (or loss) will the investors make each year with 75% occupancy? b. Repeat Part (a) when the occupancy rate is 90%. a. The profit (or loss) that the investors will make each year with 75% occupancy is million dollars per year. (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts