Question: Show Work Data: XYZ is building a new office complex. The total cost is $15,000,000. I XYZ can borrow money up to $6,000,000 at an

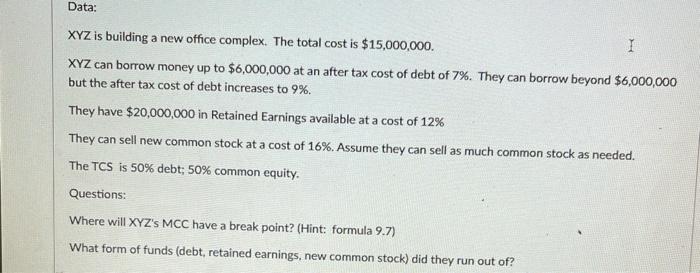

Data: XYZ is building a new office complex. The total cost is $15,000,000. I XYZ can borrow money up to $6,000,000 at an after tax cost of debt of 7%. They can borrow beyond $6,000,000 but the after tax cost of debt increases to 9%. They have $20,000,000 in Retained Earnings available at a cost of 12% They can sell new common stock at a cost of 16%. Assume they can sell as much common stock as needed. The TCS is 50% debt, 50% common equity. Questions: Where will XYZ's MCC have a break point? (Hint: formula 9.7) What form of funds (debt, retained earnings, new common stock) did they run out of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts