Question: SHOW WORK FOR ALL HIGHLIGHTED, AND ROUND ALL VALUES TO 5 DECIMALS PLEASE . Farah Jeans. Farah Jeans of San Antonio, Texas, is completing a

SHOW WORK FOR ALL HIGHLIGHTED, AND ROUND ALL VALUES TO 5 DECIMALS PLEASE.

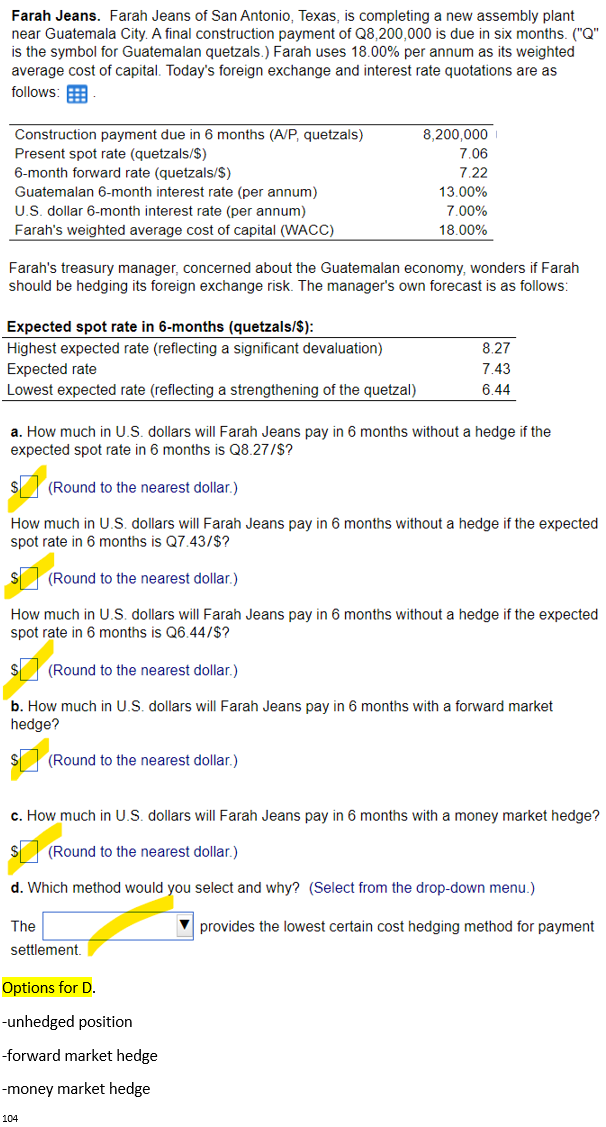

Farah Jeans. Farah Jeans of San Antonio, Texas, is completing a new assembly plant near Guatemala City. A final construction payment of Q8,200,000 is due in six months. ("Q" is the symbol for Guatemalan quetzals.) Farah uses 18.00% per annum as its weighted average cost of capital. Today's foreign exchange and interest rate quotations are as follows: Farah's treasury manager, concerned about the Guatemalan economy, wonders if Farah should be hedging its foreign exchange risk. The manager's own forecast is as follows: a. How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q8.27/\$? (Round to the nearest dollar.) How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q7.43/\$? 'Round to the nearest dollar.) How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q6.44/\$? (Round to the nearest dollar.) b. How much in U.S. dollars will Farah Jeans pay in 6 months with a forward market hedge? (Round to the nearest dollar.) Farah Jeans. Farah Jeans of San Antonio, Texas, is completing a new assembly plant near Guatemala City. A final construction payment of Q8,200,000 is due in six months. ("Q" is the symbol for Guatemalan quetzals.) Farah uses 18.00% per annum as its weighted average cost of capital. Today's foreign exchange and interest rate quotations are as follows: Farah's treasury manager, concerned about the Guatemalan economy, wonders if Farah should be hedging its foreign exchange risk. The manager's own forecast is as follows: a. How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q8.27/\$? (Round to the nearest dollar.) How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q7.43/\$? 'Round to the nearest dollar.) How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q6.44/\$? (Round to the nearest dollar.) b. How much in U.S. dollars will Farah Jeans pay in 6 months with a forward market hedge? (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts