Question: *SHOW WORK FOR ALL PROBLEMS* Problems 11, 12, 16, 17, & 18 11) Calculate the total payments on a $200,000 mortgage if payment is made

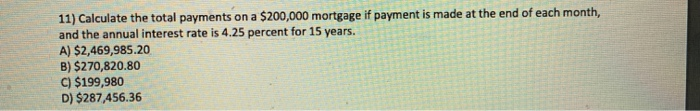

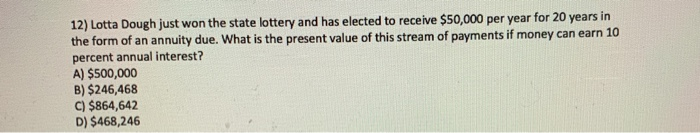

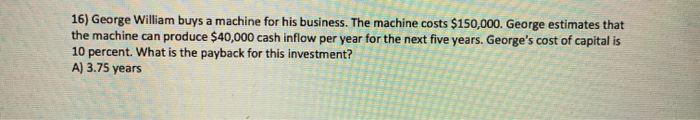

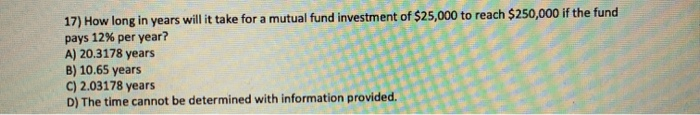

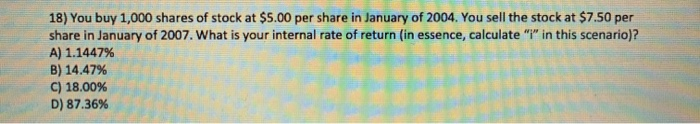

11) Calculate the total payments on a $200,000 mortgage if payment is made at the end of each month, and the annual interest rate is 4.25 percent for 15 years. A) $2,469,985.20 B) $270,820.80 C) $199,980 D) $287.456.36 12) Lotta Dough just won the state lottery and has elected to receive $50,000 per year for 20 years in the form of an annuity due. What is the present value of this stream of payments if money can earn 10 percent annual interest? A) $500,000 B) $246,468 C) $864,642 D) $468,246 16) George William buys a machine for his business. The machine costs $150,000. George estimates that the machine can produce $40,000 cash inflow per year for the next five years. George's cost of capital is 10 percent. What is the payback for this investment? A) 3.75 years 17) How long in years will it take for a mutual fund investment of $25,000 to reach $250,000 if the fund pays 12% per year? A) 20.3178 years B) 10.65 years C) 2.03178 years D) The time cannot be determined with information provided. 18) You buy 1,000 shares of stock at $5.00 per share in January of 2004. You sell the stock at $7.50 per share in January of 2007. What is your internal rate of return (in essence, calculate "l" in this scenario)? A) 1.1447% B) 14.47% C) 18.00% D) 87.36%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts