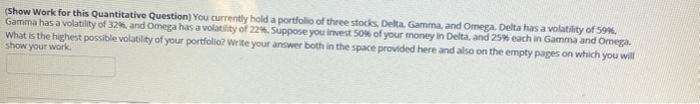

Question: (Show Work for this Quantitative Question) You currently hold a portfolio of three stocks, Delta Gamma and Omega. Delta has a volatility of 59%, Gamma

(Show Work for this Quantitative Question) You currently hold a portfolio of three stocks, Delta Gamma and Omega. Delta has a volatility of 59%, Gamma has a volatility of 32%, and Omega has a volatility of 224. Suppose you invest 50% of your money in Delta, and 25% each in Gamma and Omega Whats the highest possible volatility of your portfolio Wite your answer both in the space provided here and also on the empty pages on which you will show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts