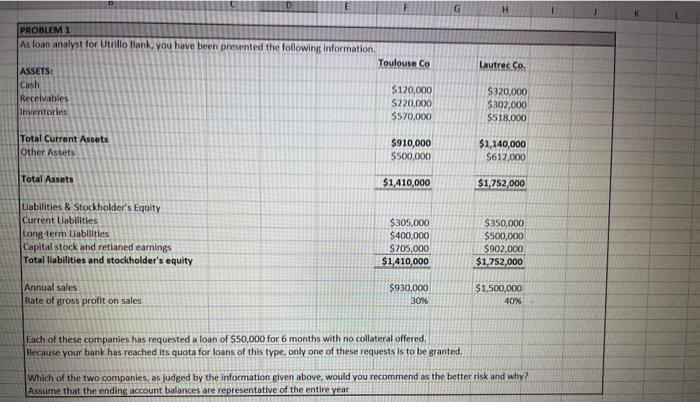

Question: show work H Lautrec Co. PROBLEM 1 As loan analyst for Utrillo Bank, you have been presented the following information, Toulouse Co ASSETS: Cash $120,000

H Lautrec Co. PROBLEM 1 As loan analyst for Utrillo Bank, you have been presented the following information, Toulouse Co ASSETS: Cash $120,000 Receivables S220,000 Inventories $570,000 $320,000 $802,000 $518,000 Total Current Assets Other Assets $910,000 $500,000 $1,140,000 5612,000 Total Assets $1,410,000 $1,752,000 Liabilities & Stockholder's Equity Current Labilities Long term Liabilities Capital stock and retianed earnings Total liabilities and stockholder's equity $305,000 $400,000 $705,000 $1,410,000 $350,000 $500,000 S902.000 $1,752,000 Annual sales Rate of gross profit on sales $930,000 30% $1,500,000 40% Each of these companies has requested a loan of $50,000 for 6 months with no collateral offered Because your bank has reached its quota for loans of this type, only one of these requests is to be granted, Which of the two companies, as judged by the information given above, would you recommend as the better risk and why? Assume that the ending account balances are representative of the entire year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts