Question: show work in excel file please Your client, Miranda, has recently retired from being the lead editor for one of the world's most famous fashion

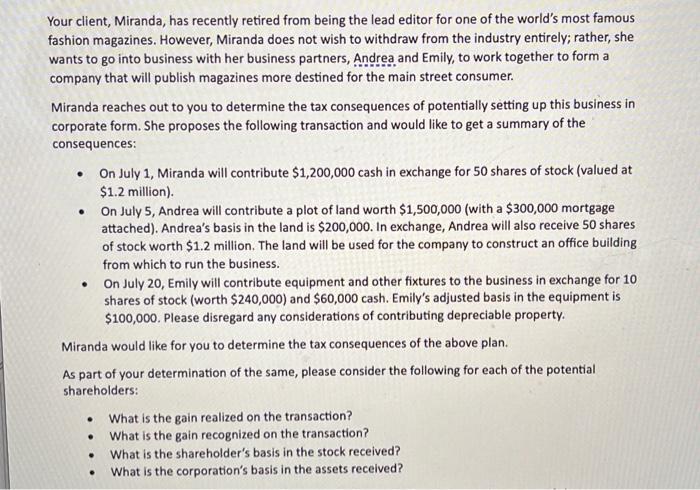

Your client, Miranda, has recently retired from being the lead editor for one of the world's most famous fashion magazines. However, Miranda does not wish to withdraw from the industry entirely; rather, she wants to go into business with her business partners, Andrea and Emily, to work together to form a company that will publish magazines more destined for the main street consumer. Miranda reaches out to you to determine the tax consequences of potentially setting up this business in corporate form. She proposes the following transaction and would like to get a summary of the consequences: - On July 1, Miranda will contribute $1,200,000 cash in exchange for 50 shares of stock (valued at $1.2 million). - On July 5, Andrea will contribute a plot of land worth $1,500,000 (with a $300,000 mortgage attached). Andrea's basis in the land is $200,000. In exchange, Andrea will also receive 50 shares of stock worth $1.2 million. The land will be used for the company to construct an office building from which to run the business. - On July 20, Emily will contribute equipment and other fixtures to the business in exchange for 10 shares of stock (worth $240,000 ) and $60,000 cash. Emily's adjusted basis in the equipment is $100,000. Please disregard any considerations of contributing depreciable property. Miranda would like for you to determine the tax consequences of the above plan. As part of your determination of the same, please consider the following for each of the potential shareholders: - What is the gain realized on the transaction? - What is the gain recognized on the transaction? - What is the shareholder's basis in the stock received? - What is the corporation's basis in the assets received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts